U.S. Fish and Seafood Exports Reach Record Levels

Contact:

Printer-friendly PDF (184.63 KB)

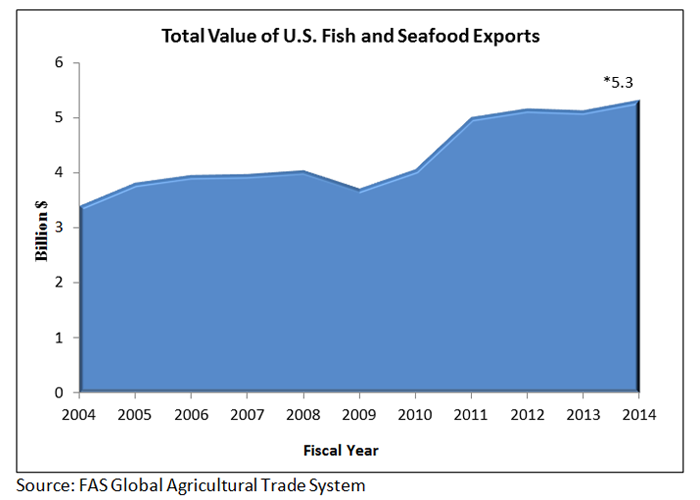

U.S. exports of fish and seafood reached a record level in fiscal year 2014, with a total value of $5.3 billion, up four percent from FY 2013. With a six-percent share of global trade, the United States is the sixth-largest supplier of fish and seafood products to the world market, behind China, Norway, Thailand, India, and the European Union. In FY 2014, U.S. fish and seafood exports were almost equal in value to U.S. exports of poultry ($5.5 billion) and were greater in value than exports of fresh fruit ($5 billion) and cotton ($4.6 billion). Over the past five years, U.S. exports have risen 43 percent in value, primarily due to higher volumes (up 38 percent), rather than rising prices. In fact, price growth for fish and seafood exports has lagged behind price growth in other protein products. In the past five years, the average unit price of exported fish rose only four percent, compared to 61 percent for beef, 28 percent for pork, and 22 percent for poultry.

Exports Rise for Wide Range of Fishery Products

U.S. exports of fish and seafood products in FY 2014 were led by lobsters, Alaskan pollock, salmon, surimi, and fish roe, which together accounted for more than 40 percent of the total value of exports. Key product groups include:

Fish (Fresh/Frozen): Fresh and frozen fish (including filets) accounted for 61 percent of U.S. fish and seafood exports, up two percent from the previous year and up 39 percent from five years ago. Pacific salmon and Alaska pollock were the top fish exports, showing much stronger growth in recent years than cod, the third-largest category of fish exported. In FY 2014, 26 percent of fresh and frozen fish exports went to China and 26 percent went to the EU.

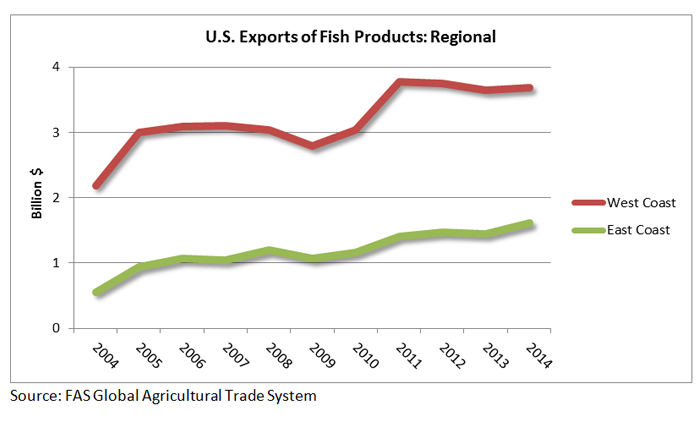

Shellfish: Shellfish accounted for 31 percent of U.S. fish and seafood exports in FY 2014. U.S. shellfish exports have grown rapidly in recent years, primarily due to higher exports of lobster and, to a lesser extent, crab. Lobster sales are driving export growth from the East Coast of the United States, and exports from this region has been largely responsible for the overall growth in fish and seafood exports in recent years (see chart below). U.S. shellfish exports were up eight percent in FY 2014, and have grown 65 percent in the past five years. In FY 2014, 20 percent of U.S. shellfish exports went to China and 19 percent went to the EU.

Other Fish Products: Other fish products (primarily roe) account for eight percent of total U.S. fish and seafood exports in FY 2104, down three percent from the previous year, but up 16 percent over the past five years. The lion’s share (51 percent in FY 2014) of U.S. roe exports go to Japan. While Russia had previously been the second-largest market for U.S. salmon roe, shipments there are currently restricted as a result of the recent Russian ban on certain U.S. agricultural and food exports.

| Top Fish and Seafood Product Exports in FY 2014 | ||

| Product | FY 2014 Value (Million US) | 5-Year Increase |

| Fish (Fresh/Frozen) | $3,233 | 39% |

| Shellfish | $1,658 | 65% |

| Other Fish Products | $429 | 16% |

| Total | $5,320 | 44% |

| Source: FAS Global Agricultural Trade System | ||

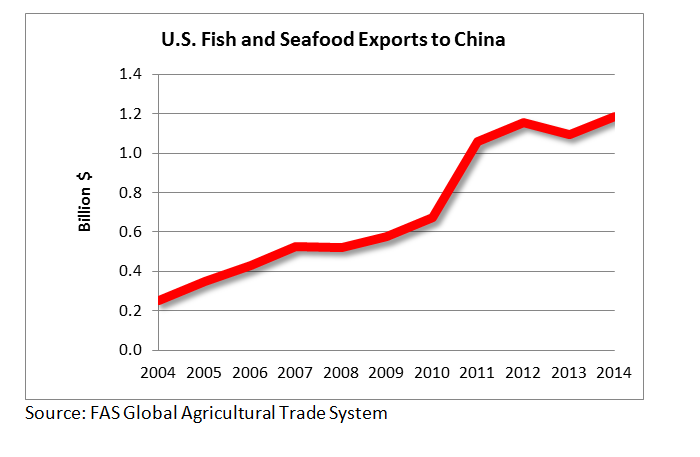

Growth Driven by Surge in Exports to China

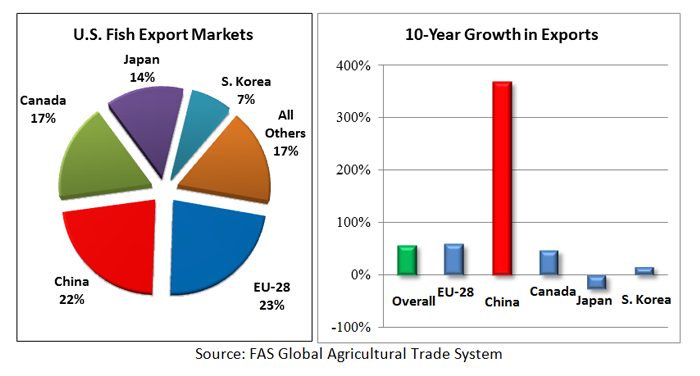

U.S. fish and seafood exports are concentrated to a few key markets, and in FY 2014 the top five export destinations (the European Union, China, Canada, Japan, and South Korea) comprised more than 83 percent of total export value. While the total value of U.S. fish and seafood exports has grown 57 percent over the past decade, exports to China have shot up by 370 percent. China accounted for only seven percent of the total value of U.S. fish and seafood exports in 2004, but now accounts for 22 percent. China will likely surpass the EU as the top export destination for U.S. fish and seafood in coming years.

Fish and seafood demand is increasing rapidly in China, the world’s largest fish and seafood consumer. While much of this demand is being met by rising domestic production, especially of aquaculture products, demand for high-value fish products also continues to surge as a result of China’s economic growth and rapidly expanding middle class. Although some U.S. fish and seafood to China is processed and re-exported, there have been rising sales of high-value products such as lobster, Pacific salmon, and crab. The United States is China’s second-largest fish and seafood supplier, after Russia.