Opportunities for U.S. Agricultural Products in Colombia

Contact:

Link to report:

Executive Summary

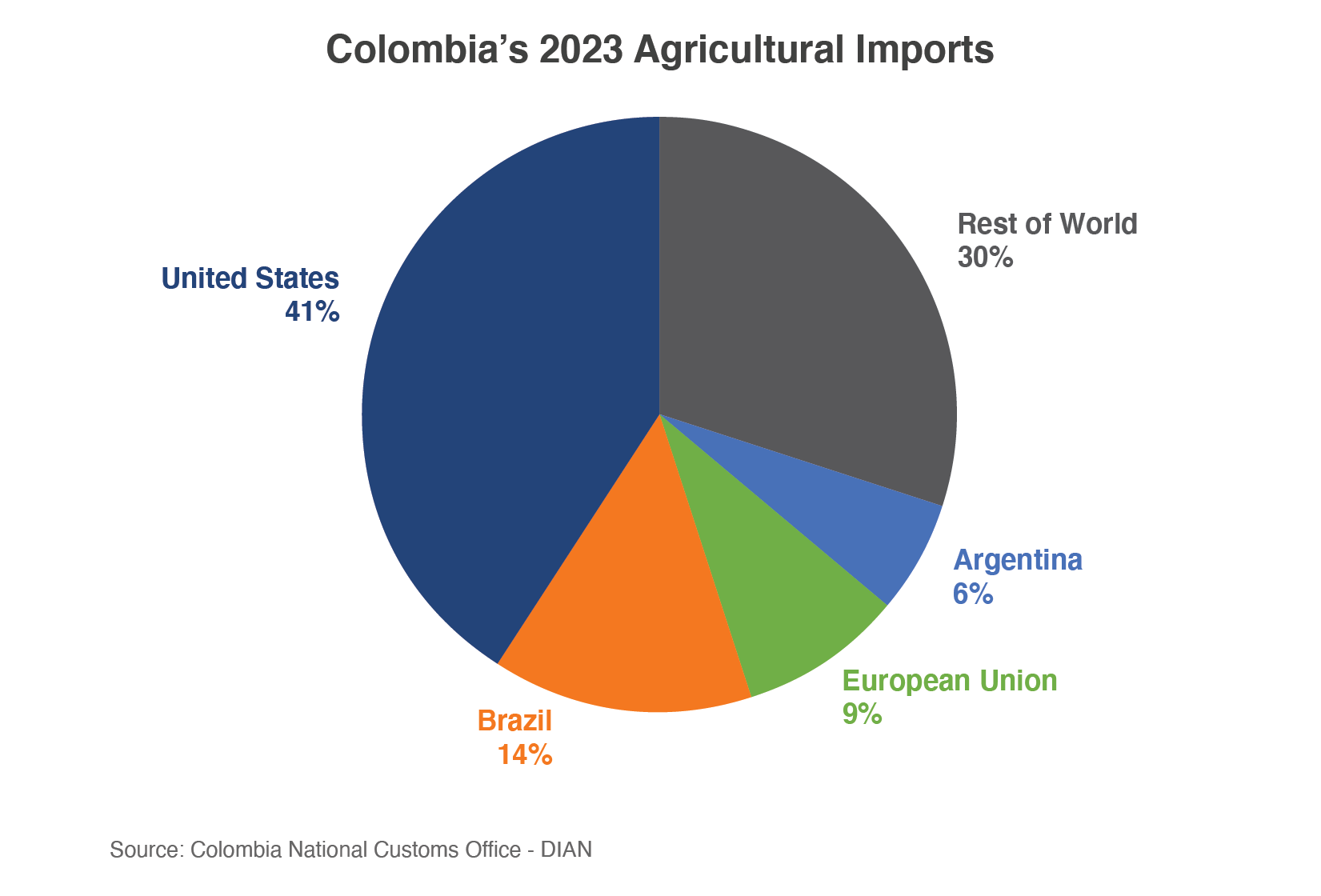

Colombia is the largest South American market for U.S. agricultural products and the seventh-largest market for U.S. food and beverage exports globally. Since the U.S. – Colombia Trade Promotion Agreement (CTPA) was implemented in 2012, U.S. agricultural exports have grown by more than 235 percent to a record $3.7 billion in 2023. While bulk products comprise the largest percentage of agricultural shipments from the United States, opportunities abound for consumer-oriented exports as Colombian incomes rise and retail outlets expand.

Macroeconomic Perspective

Colombia is the third-most populous country in Latin America with 80 percent of its 52 million inhabitants residing in cities. Strong demand for imported agricultural products will continue in coming years as macroeconomic conditions are projected to improve and consumer purchasing power rises. According to the Economist Intelligence Unit (EIU), inflation is projected to fall in 2024 and average just 3.5 percent in the next five years. The Colombian peso has appreciated 20 percent against the U.S. dollar since March 2023, reducing the cost of imports for Colombian consumers. The EIU forecasts additional strengthening of the Colombian currency through the late 2020s as the country’s fiscal deficit narrows. Real gross domestic product (GDP) growth is set to average 2.8 percent per year through the mid-2020s, slightly higher than the regional average.

According to IHS Markit, the number of middle-class households with incomes greater than $20,000 is forecast to increase 20 percent by the end of the decade. Rising wages will galvanize increased consumer retail spending. By 2030, IHS projects the market for food and beverages will grow 25 percent, eclipsing $68 billion annually. Combined with a more affordable dollar, prospects for U.S. agricultural exports to Colombia remain favorable.

Consumption Trends and Market Drivers

Although traditional tiendas (convenience stores) and markets are still very common shopping venues in Colombia, FAS Bogota reports that formal retailers now account for 60 percent of food distribution. Changes in Colombian lifestyles, such as the high prevalence of dual income households, have led to the proliferation of supermarkets and mid-sized grocery stores that offer a variety of fresh and processed foods and a streamlined shopping experience. E-Commerce has also blossomed, moving retailers to adopt digital sales platforms and accelerating the popularity of food delivery apps like Rappi and Merqueo.

Healthy lifestyles are also in vogue in Colombia as people focus more on the nutritional profile and environmental impact of products they purchase. There is high potential for U.S. exporters to provide low sugar and sodium ingredients to Colombia’s food processing industry, which accounts for 27 percent of the country’s manufacturing sector by value. Schools are also seeking distributors of healthier products like fruits, beverages, and snacks for their students.

Trade Policy

According to the Department of Commerce’s International Trade Administration, Colombia has 17 free trade agreements (FTAs) with 66 economies worldwide, including the European Union, Southern Common Market (MERCOSUR), Canada, and Mexico. Signed in 2006 and implemented in 2012, the U.S. – Colombia Trade Promotion Agreement provides duty-free access to the Colombian market for more than half of U.S. food and beverage exports, including most processed products. Other agricultural commodities such as rice and poultry are subject to duty-free tariff-rate quotas.

Recently, Colombia’s Ministry of Health and Social Protection announced front-of-pack labeling requirements for certain processed products. Octagonal warning labels are now required for foods and beverages that exceed designated thresholds of sodium, sugar, saturated fat, trans fat, and sweeteners. Promotional health claims are forbidden on front-labeled packages even if products contain one or more healthy ingredients.

It should be noted that the current administration in Colombia has taken trade restrictive actions on a limited basis affecting some agricultural imports, including from the United States. Hence, U.S. exporters should remain attentive to the political landscape within Colombia and possible trade implications of policy initiatives.

Customs clearance in Colombia is generally fast and unproblematic, although U.S. exporters should ensure products are aligned with current Colombian regulations for straightforward entry. All Colombian importers must have legal authorization to import food and agricultural products from the Ministry of Commerce, Industry, and Tourism (MINCIT). Nutritional labels must be in Spanish either on the label or on an authorized sticker affixed to the product. FAS Bogota recommends prospective exporters participate in local and regional trade shows and personally visit the market to conduct research and build relationships with importers. For additional information, please refer to USDA’s most recent Exporter Guide and FAIRS Report.

Prospects for U.S. Agricultural Exports

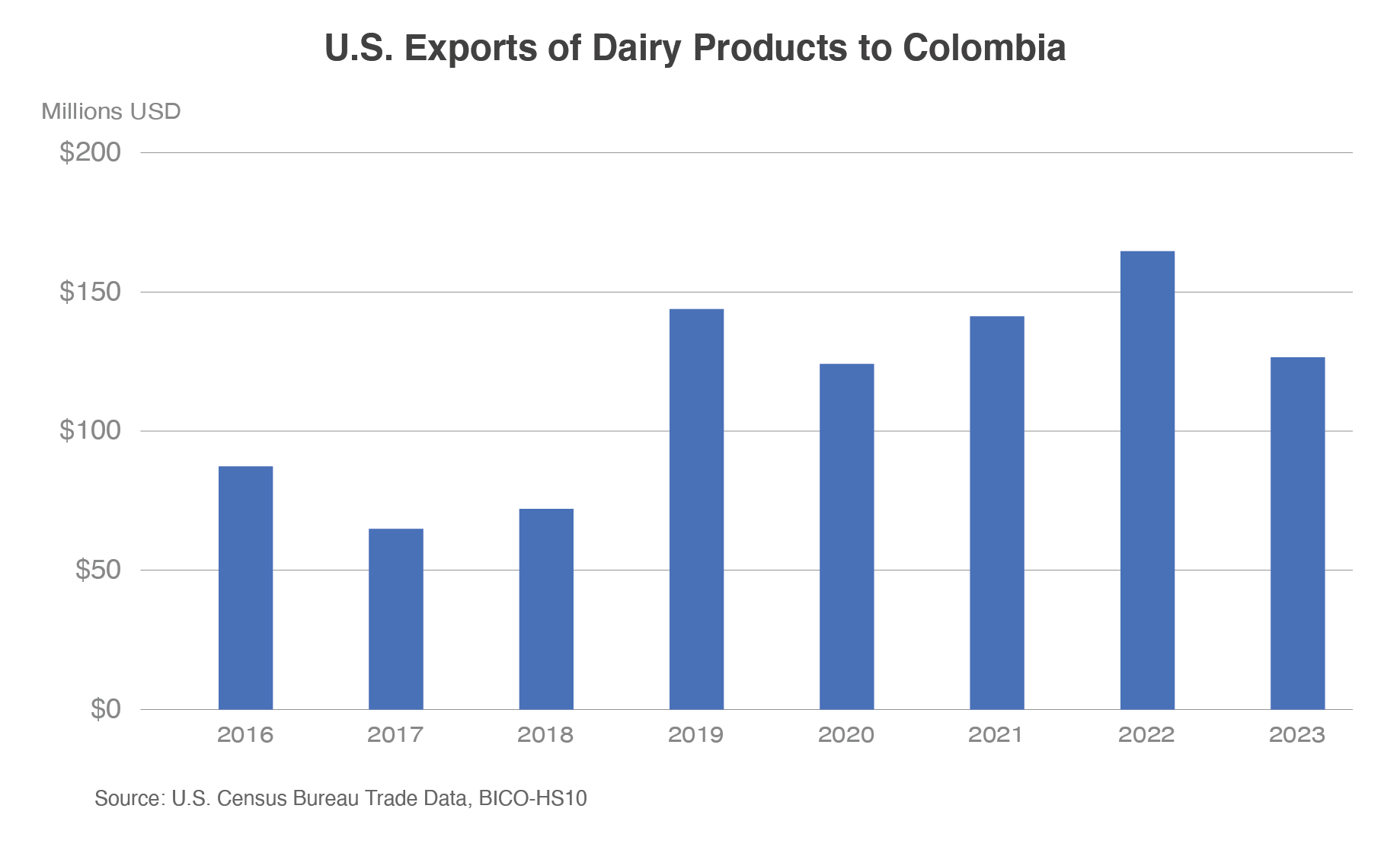

Dairy Products

U.S. exports of dairy products totaled $126 million in 2023 and ranked as the second-largest consumer-oriented export to Colombia behind pork. Dairy exports have increased more than sixfold since the CTPA entered into force in 2012 but declined 23 percent last year due to high inventories and lower consumption of fluid milk. According to Euromonitor International, Colombia’s dairy market grew 9.3 percent in 2023 to 12.9 trillion Colombian pesos ($2.7 billion) and is forecast to expand an additional 5.1 percent per annum through 2028.

Health-conscious Colombian consumers are increasingly demanding dairy products high in protein and calcium. High-protein yogurts have emerged as popular meal replacements and products with functional benefits (gut and immune system) are also gaining market share. Greek yogurt consumption is on the rise as it is perceived as a healthy product. In addition to health, rising incomes and urbanization are driving increased per capita consumption of products like cheeses. Major retailers such as PriceSmart, D1, and Jumbo have introduced foreign hard cheese varieties and launched promotional campaigns to educate consumers. Colombia also has a large, domestically important confectionery manufacturing industry that routinely sources dairy ingredients from foreign suppliers, much of it from the United States.

Prospective dairy exporters must be approved by Colombia’s Institute for Agriculture and Livestock (ICA) and have a zoosanitary certificate issued by USDA’s Agricultural Marketing Service (AMS). Dairy products are also subject to maximum sodium levels per a 2020 Resolution adopted by Colombia’s Ministry of Health. However, a recent amendment allows for U.S. exporters to self-declare sodium conformity and exempts raw materials destined for the food processing and service sectors.

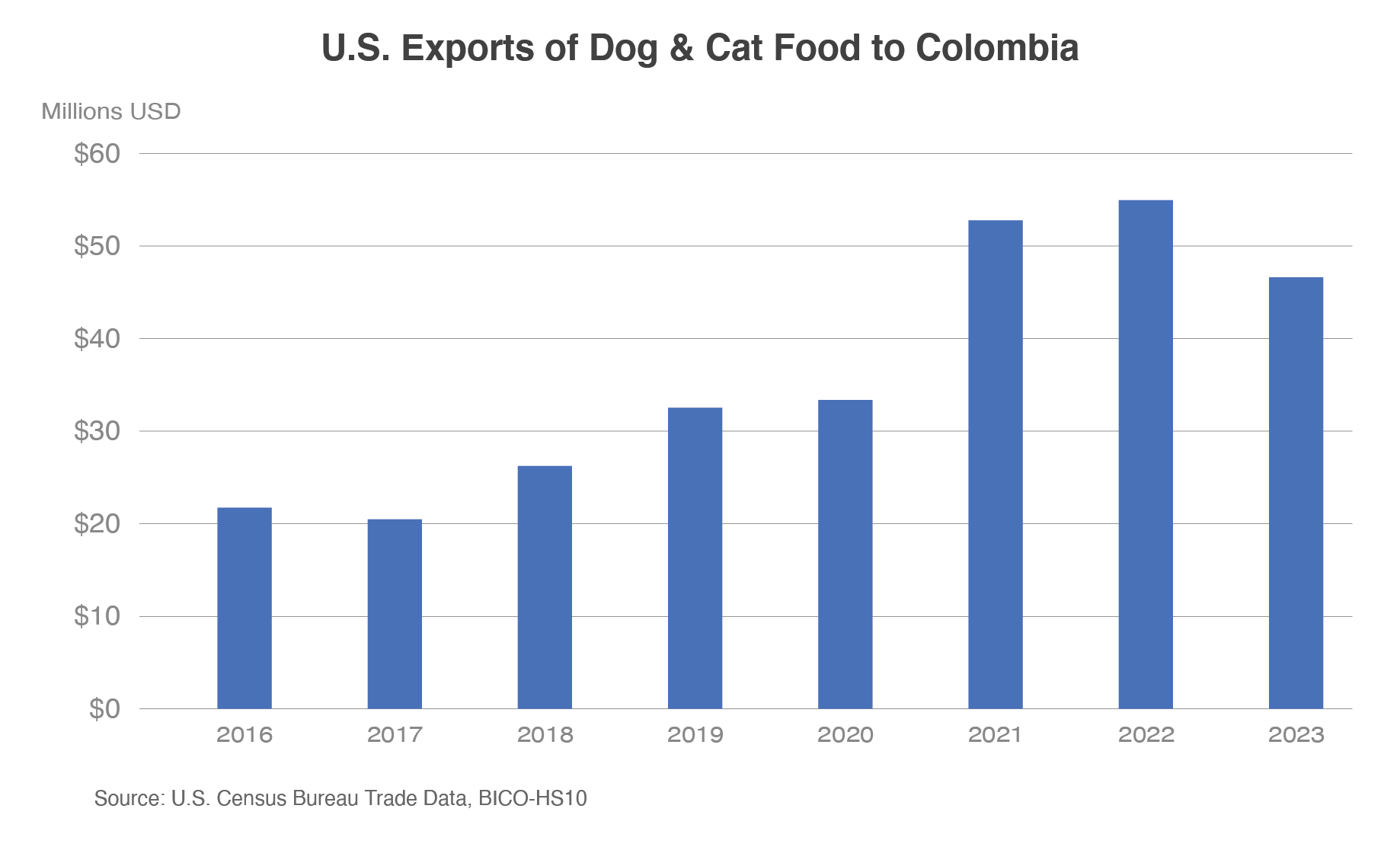

Dog & Cat Food

In 2023, U.S. exports of dog and cat food to Colombia totaled $46.6 million, their third-highest value on record. Colombia’s expanding middle class and increasing proclivity to perceive pets as valued family members bode well for future food sales. According to Euromonitor International, the market for dog and cat food grew 10 percent year-over-year in 2023 to 5 trillion Colombian pesos ($1.2 billion) and is forecast to increase an additional 7 percent per annum through 2028. In the last four years, pet ownership in Colombia rose from 25 percent to 30 percent of the total population.

Pet owners are increasingly concerned about their pets’ health and nutritional profiles, switching to products with natural ingredients and clean labels. Pet food that offers digestive or dental health benefits have strong growth potential in the Colombian market. Dog and cat treats are also gaining traction, from traditional dry snacks to natural foods, supplements, and frozen products, as consumers seek to provide their pets with a higher quality of life. In November 2023, USDA’s Animal and Plant Health Inspection Service secured market access for U.S. exports of bovine meat and bone meal (MBM) to Colombia, a common ingredient in pet food.

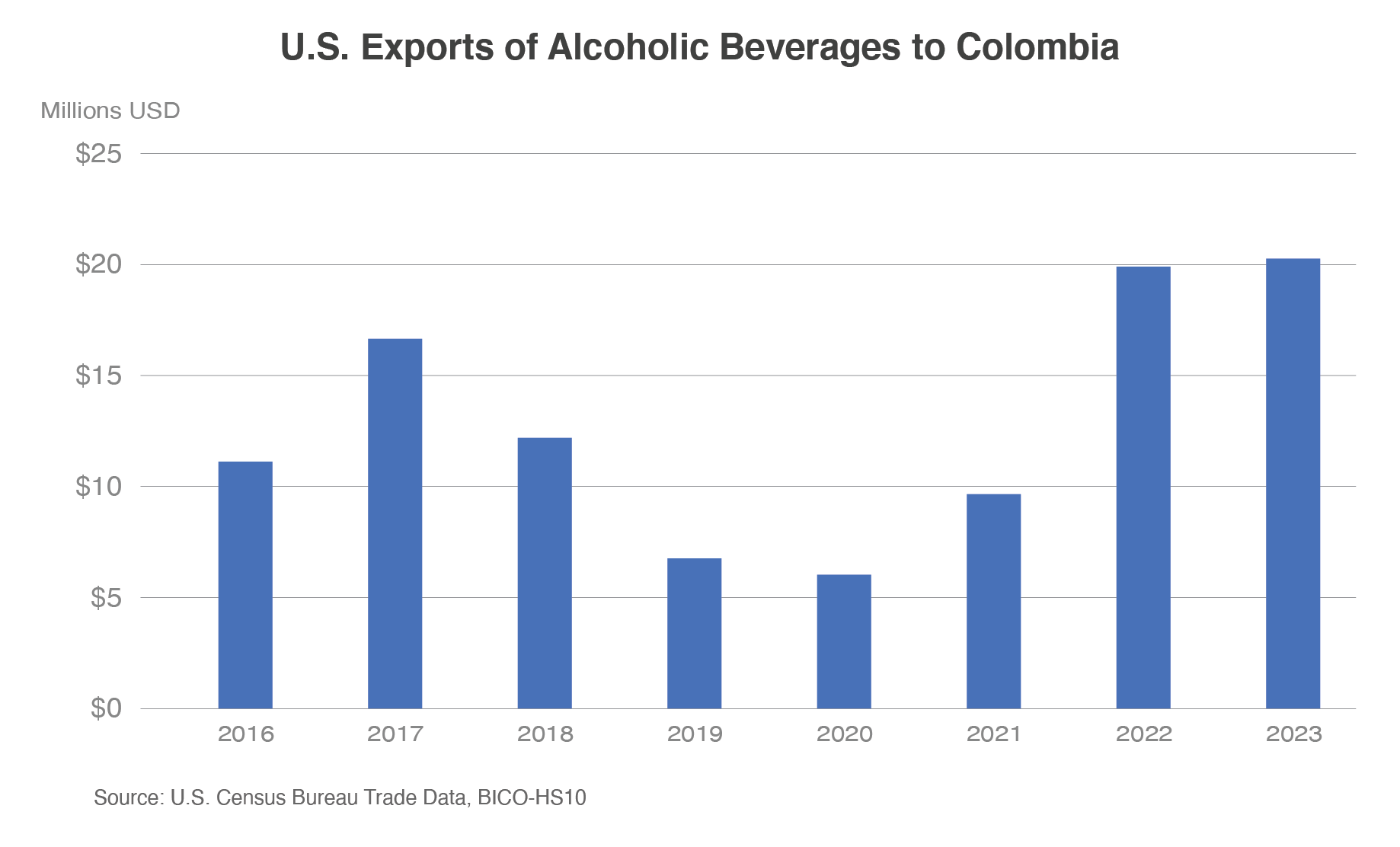

Alcoholic Beverages

U.S. exports of alcoholic beverages to Colombia increased 2 percent in 2023 to a record $20.3 million. Distilled spirits comprise most alcohol trade to Colombia, averaging 64 percent of the total from 2019 to 2023. Colombia primarily sources whiskey from the United Kingdom but interest in U.S. bourbons is growing, led by consumption of Jack Daniel’s. In addition to significant sales in modern retail, opportunities also abound for premium and craft spirits (i.e. gin, vodka, whiskies) at high-end hotels, restaurants, and social clubs in the major cities of Bogota, Medellin, Cali, and Barranquilla. Alcoholic beverage sales in Colombia are forecast to boom in the next three years, increasing 18 percent in volume terms to 3.4 billion liters by 2027.1 While beer is the most preferred drink with per capita consumption of 14.5 gallons per year, ready-to-drink products including hard seltzers and low-alcohol alternatives to traditional beverages are gaining popularity among younger consumers.

Conclusion

Already the largest South American market for U.S. agricultural products, Colombia will present additional growth opportunities for exporters as the Colombian peso stabilizes and consumer purchasing power continues its upward trajectory. Products low in sugar and unhealthy fats will fare favorably as will on-the-go options that accommodate Colombia’s active, metropolitan consumers. U.S. businesses should travel to the Colombian market to participate in trade shows, forge ties with importers, and collect industry-specific intelligence on product distribution.

1 Euromonitor International