Browse Data and Analysis

Filter

Search Data and Analysis

- 381 results found

- (-) Taiwan

- (-) Greece

- Clear all

In 2021, Taiwan was the sixth largest export market for U.S. food and agricultural products, valued over $3.78 billion. Imported food and agricultural products must comply with a range of laws designed to protect human health and prevent the introduction of animal and plant pests or diseases.

This report lists major export certificates required by the Taiwan government to export food and agricultural products to Taiwan. For more information on import requirements, see the Taiwan Food and Agricultural Import Regulations and Standards Report.

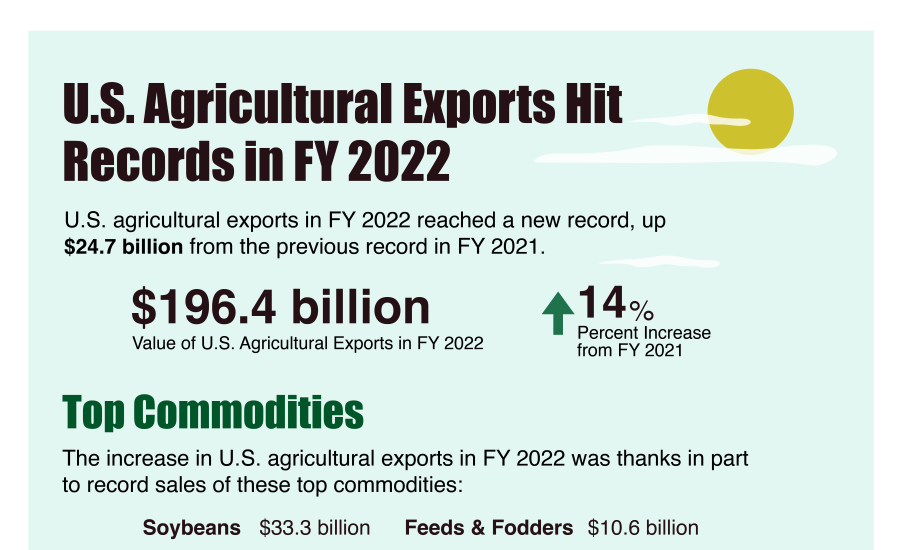

FY2022 agricultural exports reach record levels.

Taiwan’s domestic apple production rose to 1,458 MT in MY 2021/2022, though production area continues to shrink due to economic, trade, and environmental factors. Taiwan’s apple demand remains strong and consumption is almost entirely import dependent. Total imports in MY 2021/2022 were 151,260 MT and are forecast to increase to 154,000 in MY 2022/2023. The United States holds the largest market share by volume, though New Zealand is rapidly gaining market share and enjoys a tariff advantage.

Taiwan MY 2023 fluid milk production is forecast to increase to 465,000 MT. During the supply chain disruptions resulting from the COVID-19 pandemic, milk imports declined by 17 percent in MY 2021, pushing local producers to exceed production expectations to meet high demand.

Taiwan is the United States' sixth largest export market for food and agricultural products. With the highest GDP per capita in Eastern Asia, the island imported over US $30 million of coffee from the US in 2021.

Taiwan’s GDP per capita is expected to surpass Japan and Korea, making its consumers with the strongest spending power in Eastern Asia. At the same time, demand for international sweets and snacks are growing as consumers compensate for not being able to travel abroad. ATO-Taipei conducted retail research on popular products and origins to show market opportunities and preferences.

Taiwan is the seventh-largest market for U.S. agricultural exports. Taiwan has vibrant urban communities and a highly developed e-commerce industry that provides convenience for customers, all which support Taiwan’s continued demand for safe and high-quality food products. In addition, evolving consumption trends suggest customers are increasingly looking for western-style food options that cannot be locally sourced. Since domestic food production alone cannot match increased food demand, agricultural imports will continue to play an important role in Taiwan’s retail food economy. While trade barriers exist and competition intensifies, opportunities to increase U.S. agricultural exports remain promising.

On September 15, 2022, Taiwan announced the extension of tariff and tax exemptions for several agricultural commodities till the end of 2022. The tariff on beef and selective butter products and milk powder is reduced by 50 percent, the tariff on wheat and the business tax on imported corn, soybeans and wheat are waived. These measures have been in place since December 2021.

Taiwan Food and Drug Administration (TFDA) will implement new certification requirements for imported meat products, effective October 1, 2022. The current U.S. certificates for meat products will continue to be used, with the extra information required to be inserted in specific sections.

Covid-19 has accelerated digitalization and propelled emergence of new trends in Taiwan – rapidly growing cloud kitchens, popularizing at-home cooking, and expanding retail presence of frozen and prepared meals.

Taiwan's food service sector suffered a second year of decline due to the pandemic's negative effects as well as food ingredient and logistic cost inflations. Nevertheless, the US continue to be the leading supplier of various ingredients used in the market, such as beef, poultry, and cheese.