U.S. Agricultural Exports to Central America’s Northern Triangle Prosper Under CAFTA‐DR

Contact:

Printer-Friendly PDF (320.67 KB)

Central America’s Northern Triangle – which includes El Salvador, Guatemala, and Honduras – offers significant market opportunities for exporters of U.S. farm and food products. As the region continues to experience both population and economic growth, demand for imported goods – particularly high‐value, consumer‐oriented food products – is on the rise.

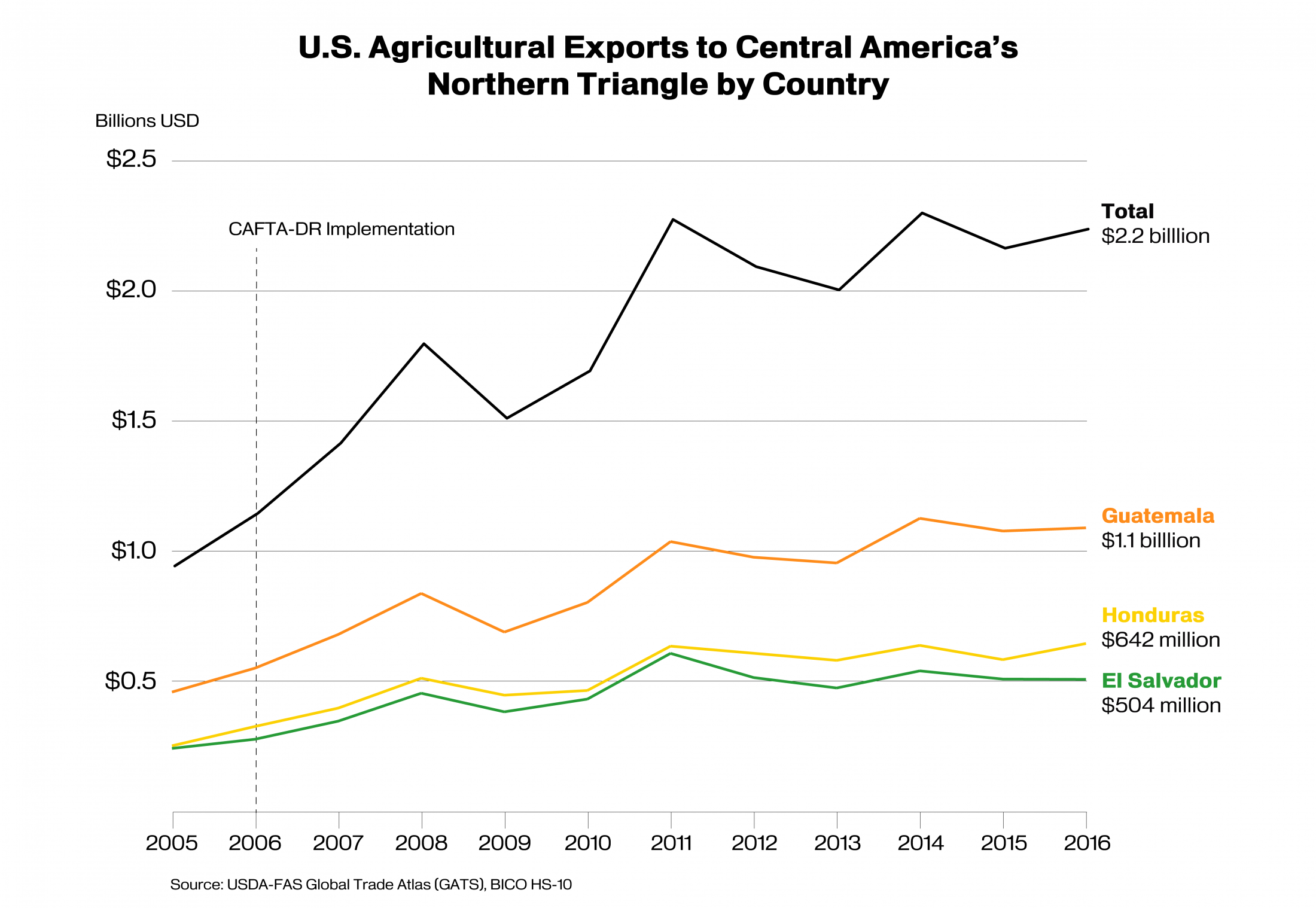

CAFTA‐DR – the United States’ free trade agreement with Costa Rica, the Dominican Republic, El Salvador, Guatemala, Honduras, and Nicaragua – has strengthened U.S. ties with Central America and helped spur economic growth, trade, employment, and expansion of the region’s middle class. Since implementation of the agreement began in 2006, U.S. farm and food exports to the CAFTA‐DR countries have doubled, reaching $4.3 billion in 2016. Exports to the three Northern Triangle countries have seen the fastest growth, doubling from $1.1 billion in 2006 to $2.2 billion in 2016.

The Northern Triangle countries have a collective real gross domestic product (GDP) of nearly $225 billion.i Guatemala, the most populous, has the largest GDP at $135.9 billion, followed by El Salvador with $49.7 billion, and Honduras with $39.2 billion. Agricultural exports play a significant role in the economic stability of the Northern Triangle, with much of the agricultural production there focused on export-oriented commodities, mainly coffee, sugar, bananas, and other tropical fruits. Consequently, bilateral trade with the United States under CAFTA-DR continues to be an important factor in the economic development of El Salvador, Guatemala, and Honduras alike.

The Northern Triangle has a relatively young and work-eligible population, with 62 percent of the 32 million inhabitants between the working ages of 15 and 64. Of the total inhabitants (excluding students and unpaid caregivers), 42 percent are in the labor force, compared to 49 percent in the United States. As local economies expand and more people move into the formal labor sector, the labor force is expected to increase from 13.5 million people in 2016 to more than 15 million in 2021, providing additional purchasing power and increasing the demand for imported goods. Although the majority of the Northern Triangle’s population earns less than $20,000ii per year, buying power may be higher than indicated due to unrecorded income from sources including remittances from family members (primarily in the United States) and work in the informal sector.

Participation in CAFTA-DR has created jobs and spurred economic growth across the Northern Triangle. Since 2006, the number of households in the region earning more than $20,000 per year has increased 40 percent, to nearly three million. Within the next five years, that number is expected to grow another 20 percent, to more than 3.5 million households. This is significant for U.S. exporters, since families with household incomes above the $20,000 threshold are likely to make their food purchases at modern retail centers and have more discretionary income to spend on imported foods.

The Northern Triangle imported $5.9 billion of agricultural products from the world in 2016. The United States was the top supplier, providing approximately 40 percent of those imports. Major U.S. competitors in the region are Mexico, the European Union, Chile, and Uruguay. Top U.S. agricultural exports to the Northern Triangle include corn, soybean meal, wheat, poultry, rice, and prepared foods.

Consumer demand for high-value products has increased in the Northern Triangle due to the population’s growing exposure to hypermarkets and modern retail chains. Another contributing factor has been awareness generated by marketing efforts such as SaborUSA, a U.S. industry effort supported by the U.S. Department of Agriculture, to promote American food products in Central and South America.

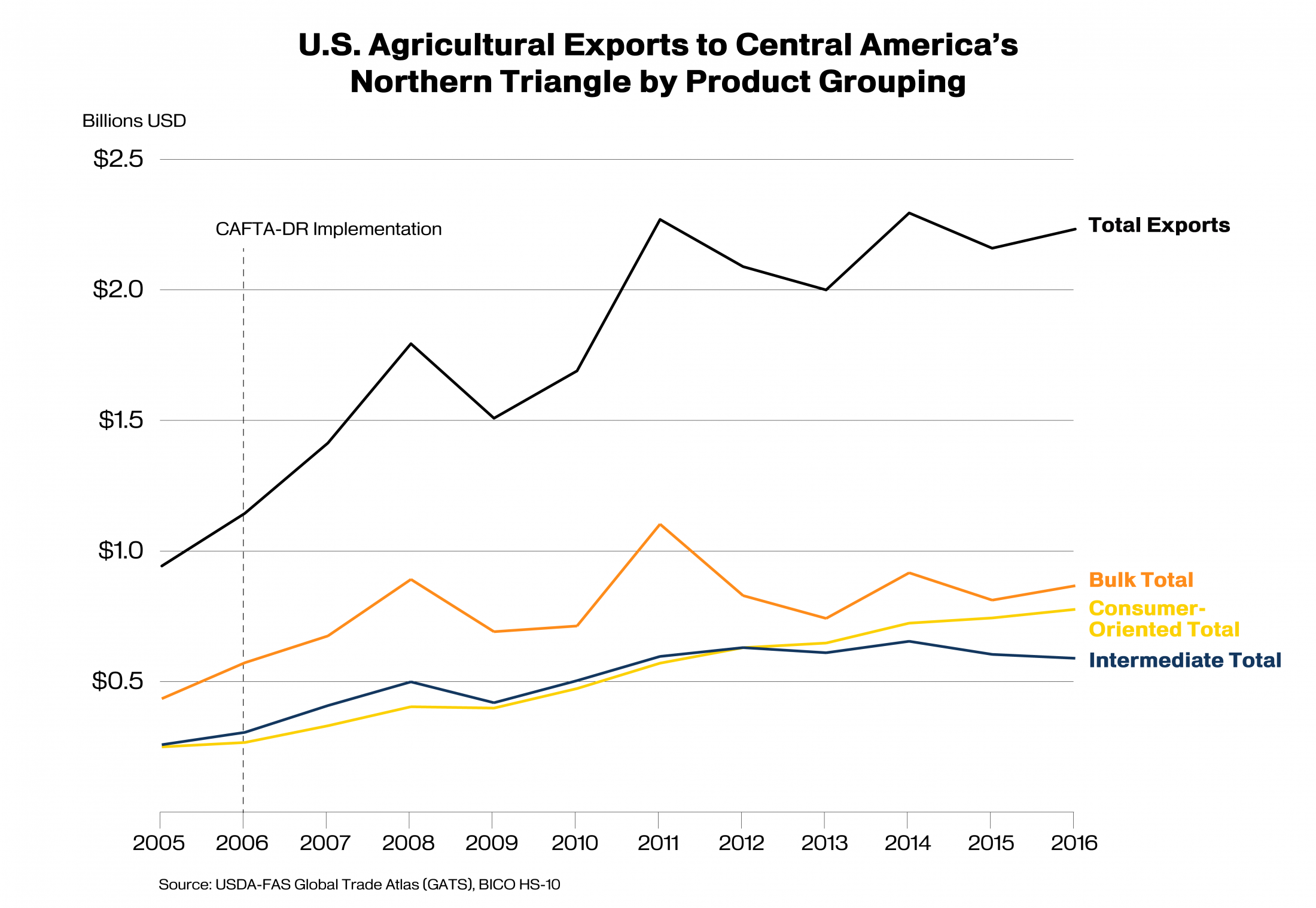

Retail food and beverages sales in the Northern Triangle countries have increased 33 percent since 2006, from $18.6 billion to $24.8 billion, and are expected to grow an additional 37 percent over the next decade. Since 2006, consumer-oriented products have been the fastest-growing category of exports from the United States to the Northern Triangle, as indicated in the table below. In addition to convenience and consumer awareness, high domestic production costs have contributed to the growth in import demand.

| U.S. Agricultural Exports to Central America’s the Northern Triangle (Values in Million US$) | |||

| Commodity | Product Group | Growth Since 2006 | Average Exports 2014-2016 |

| Corn | Bulk | 97% | $360.6 |

| Soybean Meal | Intermediate | 114% | $324.3 |

| Wheat | Bulk | 24% | $256.5 |

| Poultry Meat & Prods. (ex. eggs) | Consumer-Oriented | 248% | $137.3 |

| Rice | Bulk | 63% | $124.0 |

| Prepared Food | Consumer-Oriented | 216% | $109.5 |

| Pork & Pork Products | Consumer-Oriented | 241% | $97.7 |

| Cotton | Bulk | 3% | $96.4 |

| Dairy Products | Consumer-Oriented | 122% | $74.9 |

| Fresh Fruit | Consumer-Oriented | 48% | $53.8 |

| Processed Vegetables | Consumer-Oriented | 200% | $53.3 |

| Soybean Oil | Intermediate | 111% | $38.4 |

| Beef & Beef Products | Consumer-Oriented | 641% | $38.3 |

| Chocolate & Cocoa Products | Consumer-Oriented | 365% | $35.3 |

| Distillers Grains | Intermediate | 1321% | $33.9 |

| All Other Agricultural Exports | N/A | 69% | $394.7 |

| Total Agricultural Exports | | 95% | $2,228.9 |

| Source: USDA-FAS Global Agricultural Trade System (GATS),BICO HS-10 | |||

Honduras

iReferences to GDP are in 2010 Purchasing Power Parity (PPP). PPP is an economic theory that adjusts a country’s GDP using a "basket of goods" approach that takes into account differences in the costs of goods in different countries. This approach is generally regarded as the best comparison of domestic well-being among different countries.

iiReferences to household income throughout this report are in 2005 PPP.

iiiSource: IHS Markit Global Consumer Markets Service

ivSource: Euromonitor International