Browse Data and Analysis

Filter

Search Data and Analysis

- 7 results found

- (-) Dog & Cat Food

- (-) Europe and Eurasia

- (-) China

- Clear all

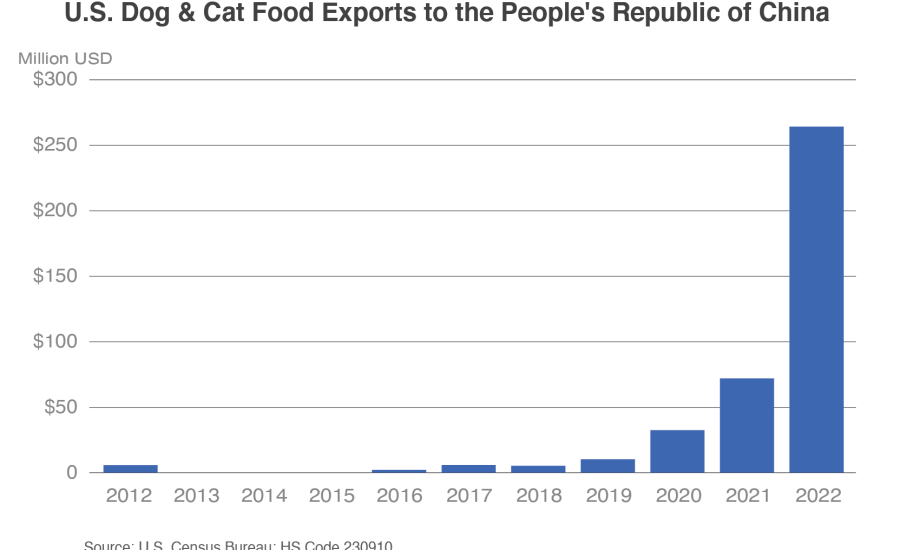

U.S. pet food exports to China have grown with the increasing number of registered facilities and approved import licenses. The largest share of Chinese pet owners lives in second-tier cities, with export opportunities for U.S. pet food brands that want to reach more of the Chinese market.

Colombia is the largest South American market for U.S. agricultural products and the seventh-largest market for U.S. food and beverage exports globally. Since the U.S. – Colombia Trade Promotion Agreement (CTPA) was implemented in 2012, U.S. agricultural exports have grown by more than 235 percent to a record $3.7 billion in 2023.

The People’s Republic of China’s (PRC) reorganized and restructured its food safety regulatory system in 2018-2019, substantially changing registration procedures and import requirements applicable to U.S. exports of feed and feed additives.

The EU adopted new rules for the labeling of organic pet food in the single market. Pet food can now be labeled with the EU organic production logo if 95 percent of its agricultural ingredients are organic.

U.S. dog and cat food exports to China reached a record $264 million in 2022, with China becoming the second-largest U.S. export market.

The People’s Republic of China (PRC) is an increasingly important market for the United States pet food and related products industry.

Since the implementation of the U.S.-China Phase One Economic and Trade Agreement in 2020, U.S. pet food exports to China have experienced significant grown. Earlier this year, the United States overtook Canada as the largest exporter of pet food to China.