Opportunities for U.S. Agricultural Products in India

Contact:

Link to report:

Executive Summary

India is the world’s most populous country and boasts one of the fastest growing economies in the world. As Indian households continue to reach higher levels of consumer spending, imported agricultural products are becoming more accessible to a larger number of people. U.S. agricultural exporters wanting to enter India’s market will have numerous opportunities to help meet this growing demand for imported food and agricultural products.

Top agricultural prospects for U.S. exporters include cotton, dairy products, ethanol, fresh fruit, forest products, processed food and beverages, pulses, and tree nuts. Recent policy changes will expand market opportunities for important U.S. products, including newly reduced tariff rates on pecans, and the removal of retaliatory tariffs on almonds, apples, chickpeas, lentils, and walnuts. Reductions to India’s most-favored-nation (MFN) rates for blueberries, cranberries, frozen turkey, and frozen duck are expected in 2024. Looking ahead, India has tremendous potential to be a large consumer of many of the high-quality and diverse agricultural products that the United States has to offer.

Macroeconomic Perspective

India is the most populous country in the world with an estimated population of 1.4 billion in 2023, according to the United Nations, and accounts for 18 percent of the total global population. Since the beginning of the 21st century, India’s population has grown substantially. While it is not the fastest growing country by percentage basis during this period, India has grown by the largest number of people with an increase of 400 million since 2000.

Key to India’s prospects as a destination for U.S. food and agricultural exports are 1) its growing gross domestic product (GDP), 2) consumer spending, and 3) urbanization. Following a period of decline during the COVID-19 pandemic, India’s real GDP recovered in fiscal year (FY) 2021 (October-September), and in FY 2022 it grew at an estimated 6.9 percent – among the highest of any country. At the same time, Indian households have been increasing consumption spending – a trend that is expected to continue. S&P Global forecasts that during the next 5 years, Indian households will become the biggest spenders among the G20 economies, driven by compound annual spending growth averaging 6.6 percent per year (compared to the G20 average of 2.7 percent). Finally, despite slowing slightly in recent years, India’s urban population has continued to grow. In 2022, the World Bank estimated that 508 million Indians (around 36 percent) live in urban areas, up 2 percent from 2021.

India’s population and these macroeconomic factors are important parts of what make India a strong future prospect for U.S. exports. In addition to population growth, a rapidly expanding distribution and retail network are making imported food and other agricultural products more accessible to a higher proportion of people. India has potential to be a large consumer of many of the high-quality and diverse agricultural products that the United States has to offer. This will become increasingly critical as India’s ability to feed its growing population on its own will be challenged by the impact of climate change on its production capabilities. India is already confronting production problems resulting from depleted water reserves, soil degradation, increasingly erratic weather, and labor migrating to urban areas.

Agricultural Trade Overview

Top India Agricultural and Related Product Imports from the World

Million USD, Fiscal Year (Oct-Sep)

| Product | 2019 | 2020 | 2021 | 2022 | 2023 |

| Vegetable Oils | 9,398 | 9,872 | 15,385 | 21,456 | 18,406 |

| Tree Nuts | 2,426 | 2,246 | 2,486 | 3,546 | 2,796 |

| Pulses | 1,400 | 1,468 | 1,831 | 2,035 | 2,642 |

| Forest Products | 2,202 | 1,494 | 1,968 | 2,222 | 2,259 |

| Industrial Alcohols & Fatty Acids | 724 | 571 | 942 | 1,338 | 832 |

| Sugars & Sweeteners | 373 | 490 | 469 | 195 | 821 |

| Spices | 554 | 575 | 727 | 766 | 810 |

| Cotton | 1,186 | 496 | 475 | 1,320 | 733 |

| Fresh Fruit | 378 | 332 | 600 | 579 | 568 |

| Distilled Spirits | 362 | 247 | 258 | 485 | 567 |

| Agricultural Products | 22,122 | 21,317 | 28,640 | 38,405 | 34,526 |

| Agricultural & Related Products | 24,489 | 23,017 | 30,844 | 40,874 | 37,006 |

Agricultural & related products includes all agricultural products plus forest products, seafood, and biodiesel.

Source: Trade Data Monitor, LLC – BICO HS-6.

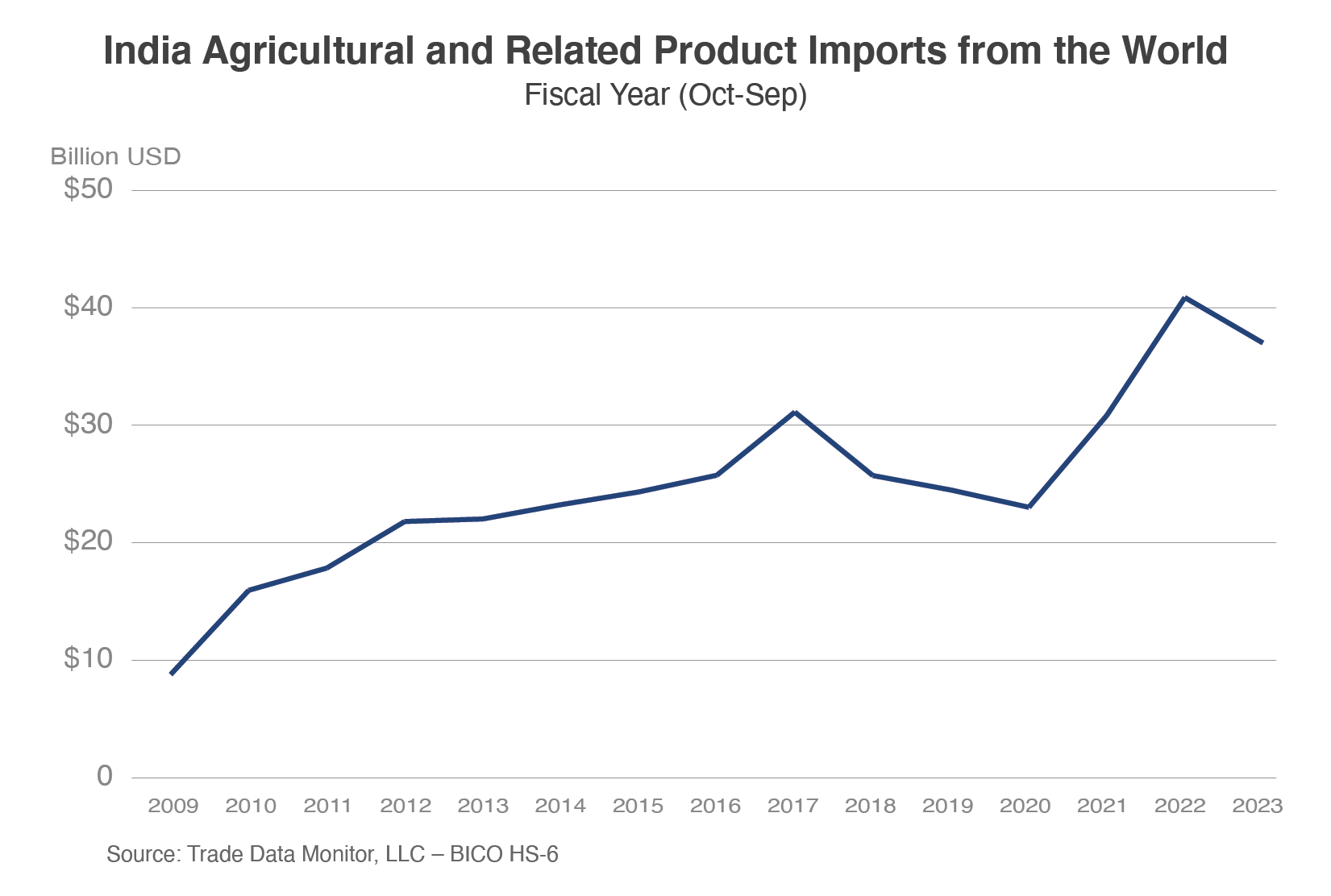

In FY 2023, India imported $37 billion of agricultural and related products from the world. In the past 5 years, India’s imports have grown substantially, up by $12.5 billion (51 percent) from FY 2019. India is ranked as the eighth largest global importer of agricultural and related products. Proportional to its population, India imports a relatively small value of products. Comparatively, China, a country with a similar population size, imported $262.7 billion during the same period. Currently, India ranks behind much lower population countries like Canada and South Korea in total agricultural and related imports. This relatively low level of imports suggests good opportunities for future growth.

Much of India’s import growth in recent years can be attributed to the growth of vegetable oils, by far India’s top imported agricultural product. Imports of vegetable oil increased by $9 billion, nearly doubling in 5 years, to a total of $18.4 billion in FY 2023. Palm oil, a product that the United States does not produce in substantial quantities, comprises more than half of India’s vegetable oil imports, totaling $9.9 billion in FY 2023. Soybean oil is India’s second most imported oil, totaling $4.8 billion and comprising more than a quarter of vegetable oil imports in FY 2023.The United States has occasionally been a supplier of soybean oil to India when market conditions are favorable, including in FY 2022, but imports face stiff competition from other substitutable oils like palm and sunflower, and from imports from India’s traditional soybean oil suppliers, Argentina and Brazil.

Tree nuts were the second largest category of imported products in FY 2023, reaching $2.8 billion. India’s top imported type of tree nuts were cashews, valued at $1.4 billion, which are generally imported for processing from growing countries like Cote d’Ivoire and Ghana. India is a major producer and exporter of shelled cashews. India’s second most imported type of tree nuts were almonds, a vast majority of which were supplied by the United States, valued at $932 million. These were followed by pistachios, valued at $201 million, and areca nuts (also known as a betel nut, a chewed product consumed in many South and Southeast Asian countries), valued at $156 million.

India is the world’s largest importer of pulses, a category which contains legumes, such as lentils and beans. Pulses are a major source of protein in India, particularly for the country’s large number of vegetarians. India imported $2.6 billion of pulses in FY 2023. Lentils were the top exported pulse, valued at $1.0 billion. Lentil imports increased significantly during the past 5 years, up by $748 million (286 percent) from $262 million in FY 2019. Other major pulse imports included pigeon peas, valued at $792 million, and mung and urad beans, valued at a combined $555 million. India is a large consumer of pulses, and supplements with imported product when domestic production is insufficient. Top suppliers include Burma, Canada, and Australia.

Other major agricultural and related products imported in FY 2023 include forest products ($2.3 billion), industrial alcohols and fatty acids ($832 million), and sugar and sweeteners ($821 million). The European Union is India’s top supplier of forest products, providing mostly planks of pine, spruce, and fir. India also imported a large value of tropical woods and veneers from Malaysia and Indonesia. Industrial alcohols and fatty acids, ingredients used by both the food industry and in the production of cosmetics and detergents, were mostly imported from Indonesia and Malaysia. Nearly 95 percent of India’s imports of sugar and sweeteners were from Brazil in the form of raw cane sugar.

Opportunities for U.S. Exports

Top U.S. Agricultural and Related Product Exports to India; Million USD Fiscal Year (Oct-Sep)

| Product | 2019 | 2020 | 2021 | 2022 | 2023 |

| Tree Nuts | 776 | 884 | 892 | 1,022 | 1,005 |

| Cotton | 571 | 155 | 196 | 518 | 237 |

| Ethanol | 318 | 330 | 199 | 250 | 148 |

| Forest Products | 55 | 40 | 47 | 80 | 81 |

| Essential Oils | 31 | 29 | 33 | 40 | 56 |

| Dairy Products | 56 | 47 | 29 | 36 | 39 |

| Other Feeds, Meals & Fodders | 12 | 16 | 23 | 28 | 29 |

| Seafood Products | 32 | 32 | 51 | 41 | 29 |

| Dextrins, Peptones, & Proteins | 45 | 25 | 32 | 26 | 27 |

| Soybeans | 5 | 43 | 5 | 7 | 26 |

| Agricultural Products | 2,112 | 1,738 | 1,644 | 2,416 | 1,731 |

| Agricultural & Related Products | 2,200 | 1,811 | 1,742 | 2,538 | 1,842 |

Source: U.S. Census Bureau Trade Data – BICO HS-10

India, despite its rapidly growing economy and population growth, remains a price sensitive market. U.S. export growth, without the further removal of tariffs, will remain constrained. India is negotiating and agreeing to free trade agreements with several U.S. competitors, including Australia and the United Kingdom. Competitors, for example, were able to take advantage of the Section 232 retaliatory tariff restrictions to gain market share; despite many retaliatory tariffs being lifted in 2023, it will be challenging to regain market share for the impacted products.

Opportunities for Bulk, Intermediate, and Agriculture Related Products

In FY 2023, $267 million of bulk products comprised 14 percent, $340 million of intermediate products comprised 28 percent, and $110 million of related products (including forest products, seafood, and biodiesel) comprised 6 percent of total U.S. agricultural and related exports to India. Major exported bulk products, consisting of commodities which have received little or no processing, included cotton ($237 million) and soybeans ($26 million). Major exported intermediate products, consisting of commodities which have received some processing but are generally not ready for final consumption, included ethanol ($148 million), essential oils ($56 million), miscellaneous feeds, meals, and fodders ($29 million), and dextrins, peptones and proteins ($27 million). Major exported agriculture related products included forest products ($81 million), and seafood ($29 million).

Bulk, intermediate, and agriculture related products with high potential for U.S. exporters include pulses, cotton, ethanol, forest products, and seafood.

Pulses, as outlined in the previous section, are one of India’s top imported product groups. The United States is not a top supplier to India, despite being the world’s fourth largest exporter of pulses in FY 2023. Less than $1 million of the United States’ $880 million total pulse exports went to India. This is down significantly from the record year, FY 2014, when the United States exported $174 million of pulses to India. A major constraint in recent years was the imposition of Indian retaliatory tariffs affecting major U.S. pulse products in 2018. Retaliatory tariffs on U.S.-origin chickpeas and lentils were removed in 2023, allowing U.S. pulses to resume competitiveness and paving the way for increased exports to India. Restrictions facing imported yellow peas and lentils have also been eased, exempted from duties through March 2025.

Cotton is another high-potential product for U.S. exporters. India is a major producer, consumer, exporter, and importer of cotton. The United States is India’s top supplier of cotton. India’s large domestic textiles sector relies on imported cotton to meet demand, as domestic supply is not consistently sufficient for all types of cotton. In particular, India is a major consumer and importer of long and extra-long staple cotton. While India was only the seventh largest destination for U.S. cotton in FY 2023, it was the largest destination for U.S. extra-long staple Pima cotton, accounting for $122 million of the total $283 million exported to the world. As India’s textile sector continues to grow, U.S. exports will fill an important role supplying cotton, especially high-quality long and extra-long staple products. However, it is important to note that cotton imports overall face tariffs that significantly limit market access.

Ethanol is imported by India for medical and industrial uses, and the United States has long been the top supplier, most recently capturing 84 percent of the import market in FY 2023. Importing ethanol for fuel blending is prohibited. India is a major producer of ethanol, with a large potable market as well as many industrial uses. In recent years, domestic production supports its ambitious fuel blending mandate. Ethanol is used in manufacturing to produce disinfectants and hand sanitizers (which recently saw a spike in world production and use due to the COVID-19 pandemic), as well as solvents, carriers in foods and cosmetics, commercial deicers, pharmaceuticals, and organic chemicals. Growth in India’s manufacturing of these products will boost import demand, providing growth opportunities for U.S. exporters.

Forest Products and Seafood, which are not included in USDA’s definition of agriculture but are considered related products, are among the top products exported from the United States to India. Nearly half of all U.S. forest product exports in FY 2023 were pine logs, while much of the remainder was pine products such as planks. Demand for forest products is driven by a few large furniture manufacturers and many small-scale handicraft producers. Generally, consumers are very price conscious. India is a growing market for U.S. forest products, reflecting growing demand for building materials, which will likely continue in the coming years. U.S. seafood exports in FY 2023 were led by shrimp, with $17 million exported to India. India is one of the world’s largest exporters of seafood, but also imports a variety of seafood products from many suppliers. Demand for further variety may provide opportunities for U.S. exporters to supply products not produced domestically in India.

Opportunities for Consumer-Oriented Products

In FY 2023, consumer-oriented products comprised around 61 percent of total U.S. agricultural and related product exports to India. Major consumer-oriented products, consisting of products that are generally ready for final consumption, included tree nuts ($1 billion), and dairy products ($39 million).

Consumer-oriented products with high potential for U.S. exporters include tree nuts, fresh fruit, dairy products, and processed food and beverages.

Tree Nuts were the top U.S. product exported to India in FY 2023, accounting for more than half of all agricultural and related product exports. India is a major market for the United States’ top three exported tree nuts: almonds, pistachios, and walnuts. In FY 2023, almond exports reached $834 million, while exports of pistachios reached $145 million, and exports of walnuts reached $24 million. Like pulses, tree nuts were also impacted by retaliatory tariffs imposed by India in 2018. The retaliatory tariffs were removed for almonds and walnuts in fall 2023, allowing for market access and continued growth for the top U.S. products exported to India. Future prospects are also strong for U.S. pecans, which were reclassified and assigned a new reduced tariff in summer 2023.

Fresh Fruit was previously a top U.S. product group exported to India, reaching a record $176 million in FY 2018, but declined in recent years following retaliatory tariffs imposed on U.S. apples in 2018. Apples make up the majority of U.S. fresh fruit exports, comprising 95 percent in FY 2018. Fresh fruit exports in FY 2023 totaled only $3 million. With the removal of retaliatory tariffs in 2023, U.S. apple exports can reestablish their market opportunities, and work toward setting new records in the future. India also recently agreed to reduce MFN tariffs on several products including cranberries and blueberries which should benefit U.S. fresh fruit exporters when implemented in 2024.

Dairy Products are widely consumed in India, and most are supplied by domestic production. Policy restrictions limit the amount and type of dairy products eligible for import. Despite this, India imported a substantial amount from the world in FY 2023, valued at $363 million. Dairy products are also among the top U.S. products exported to India, with exports consisting mostly of milk albumin (such as concentrates of two or more whey proteins) and lactose. These products, used in manufacturing, are often destined for non-food uses such as pharmaceuticals and in the production of dietary supplements. Milk albumin and lactose are India’s top imported dairy products from the world, and imports have grown substantially in recent years. The United States has a relatively small market share in this segment of India’s dairy imports, behind the European Union and New Zealand.

Processed Food and Beverages, including products such as snack foods, sauces and condiments, prepared foods and ingredients, and alcoholic beverages have strong prospects in India. Increased demand for imported processed products often accompanies rising household income levels and urbanization, enabling consumers to shop more frequently at larger grocery stores that are likely to stock imported retail items. Imported retail products may be more expensive than domestically-produced products, but middle- and high-income consumers are likely to pay a premium to experience a greater variety or find specific imported products. In FY 2023, the United States exported $160 million dollars of processed food and beverages to India. Top categories included prepared foods and ingredients ($68 million), alcoholic beverages ($21 million), canned fruit ($9 million), and condiments and sauces ($6 million). U.S. alcoholic beverage exports have grown particularly fast in recent years, more than doubling in the past five years, driven by increased whiskey exports.

Trade Policy

Consistent with Prime Minister Modi’s “Make in India” and “Self-Reliant India” policies, India impedes agricultural trade with high tariffs and non-tariff barriers. India’s applied tariffs on most agricultural and consumer-ready food products range between 30-40 percent, with bound tariffs as high as 150 percent. The Indian Government routinely enacts sanitary and phytosanitary measures and other non-tariff barriers, particularly in the biotechnology space, that are not based on science- or risk-based approaches. Moreover, India intervenes in the market with price-distortive measures that negatively impact farmers and consumers on a global scale. It applies export bans and restrictions on critical food staples, such as wheat and rice, and maintains minimum-support price schemes for those and other crops where subsidized production also significantly contributes to greenhouse gas emissions, poor air quality, and the depletion of natural resources.

The U.S.-India Trade Policy Forum (TPF) is the principal mechanism to advance bilateral trade between the two countries. Through the TPF, India agreed to improved market access for U.S. pork, cherries, and alfalfa hay in 2021 and 2022. However, pork shipments have not taken off, and India has not fulfilled its obligation to import alfalfa hay due to biotech concerns. In 2023, India agreed to reduce its MFN tariff on 10 agricultural products. Following the 2023 TPF ministerial, India reduced its tariffs on pecans from 100 percent to 30 percent. During Prime Minister Modi’s State Visit, the United States and India announced the resolution to six non-agricultural World Trade Organization (WTO) disputes. Part of the resolution included India agreeing to lift its 2019 retaliatory tariffs of 10 to 20 percent on U.S. almonds, apples, chickpeas, lentils, and walnuts, which went into effect in September 2023. On the margins of the 2023 G-20 Leaders’s Summit, the Office of the U.S. Trade Representative announced a resolution to the final outstanding WTO dispute against India’s ban on U.S. poultry and egg imports due to unsubstantiated avian influenza claims. During the Summit, India also agreed to reduce its MFN tariffs on blueberries, cranberries, frozen turkey, and frozen duck destined only for high-end hotels and restaurants. Tariffs are expected to be reduced by March 2024 from 30 percent to a range within 5 to 10 percent, depending on the Harmonized System code.