Opportunities for U.S. Agricultural Exports in Mexico

Contact:

Printer-friendly PDF (259.09 KB)

Mexico is the second-largest export market of agricultural products from the United States. Over the last decade, U.S. agricultural exports to Mexico grew 48 percent from $12.9 billion to $19.1 billion in 2018. Nearly 14 percent of all U.S. agricultural exports went to Mexico last year. The Mexican market for U.S. farm products is diverse and well-integrated with U.S. supply channels. Open trade with Mexico provides opportunities for cross-border collaboration between businesses, and as a result, United States and Mexico bilateral agricultural trade totaled $45 billion in 2018. High-value, consumer-oriented products such as dairy and livestock products, fruits, nuts, and processed foods account for the largest share of U.S. agricultural exports to Mexico and were valued at $8.6 billion in 2018. Mexico also has a strong livestock sector, which depends on U.S. feed grains and oilseeds imports. Overall U.S. bulk commodity exports to Mexico totaled $6.6 billion in 2018, with Mexico the top market for U.S. corn shipments. Mexico’s livestock sector also provides opportunities for intermediate U.S. products such as soybean meal and distillers’ dried grains. Mexico’s food processing sector is a strong market for U.S. sweeteners, fats and oils, and other food processing inputs. Overall U.S. exports of intermediate products to Mexico totaled more than $3.9 billion in 2018.

Demographic and Macroeconomic Considerations

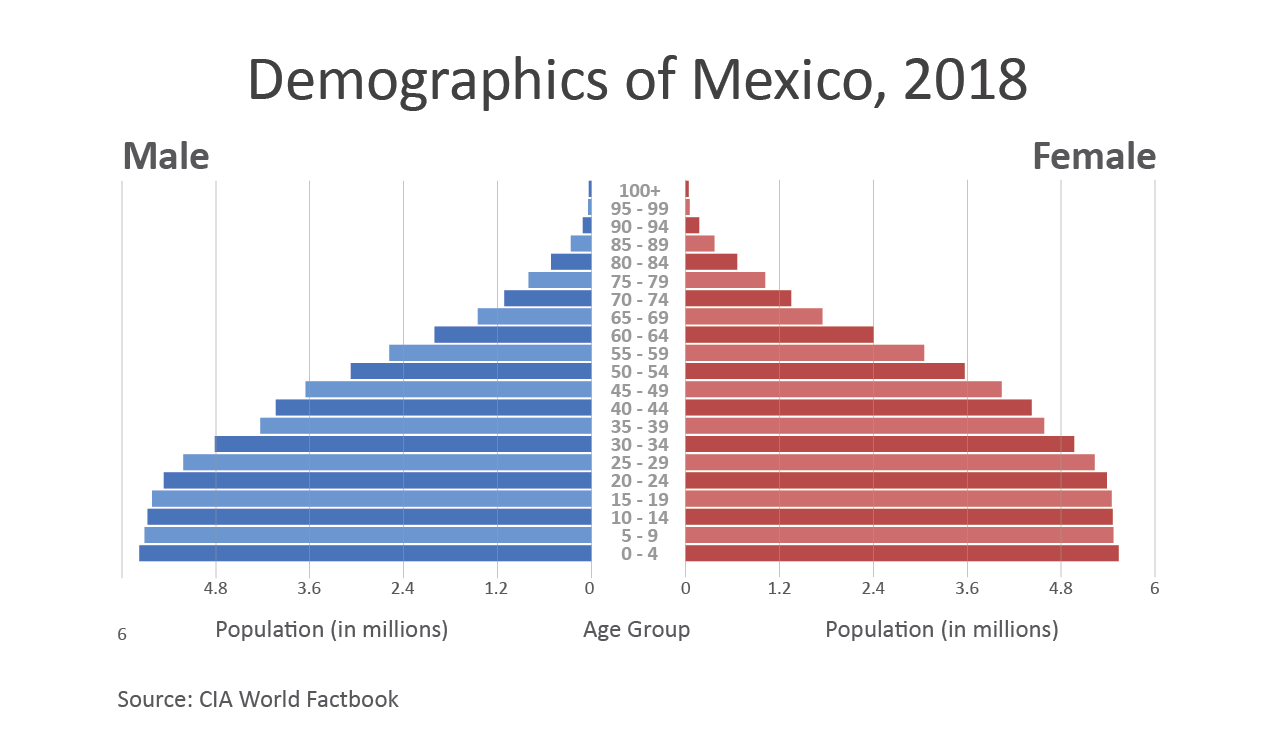

Mexico’s population is the world’s 11th largest at nearly 126 million and skews younger than the United States, with a median age under 29 years old, compared to 38 years old in the United States. A larger portion of Mexico’s population are young adults, or will be young adults soon, with growing consumer incomes. Age demographics matter for new-to-market exporters seeking to establish a customer base. Understanding age trends may also help exporters anticipate changing tastes and preferences in their long-term strategic marketing plans.

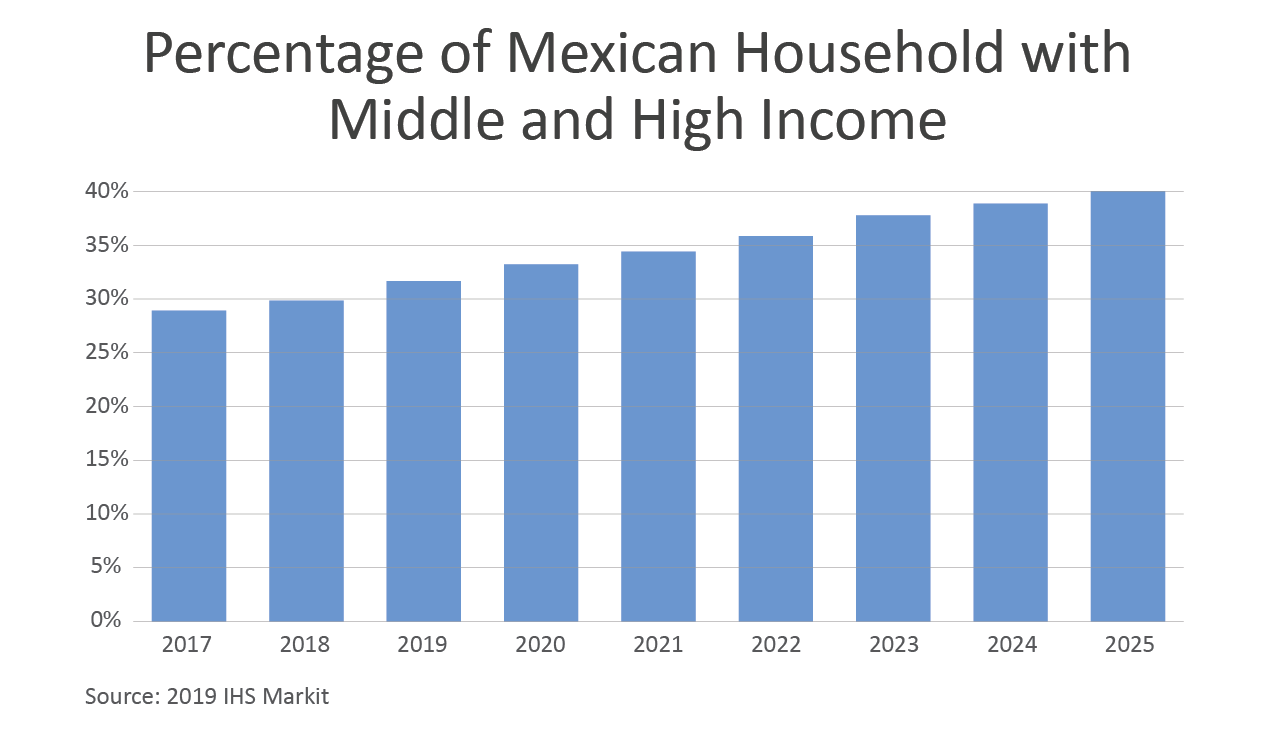

Mexico’s economy is the world’s 11th largest with a gross domestic product of nearly $2.5 trillion in 2018, on a purchasing power parity basis. Middle- and high-income households in Mexico are expected to grow from 30 percent of all households in 2018 to over 40 percent of all households by 20251. This is good news for U.S. exporters since consumer demand patterns shift toward a greater diversity of higher quality meats, produce, and processed foods when incomes rise. This trend will provide new opportunities for U.S. farmers, ranchers, and food processors to expand their consumer base in Mexico and increase sales.

U.S. Agricultural Export Composition to Mexico

Mexico ranked as the top U.S. export market in 2018 for: corn ($3.1 billion), dairy products ($1.4 billion), poultry meat & eggs ($1.1 billion), sugars & sweeteners ($649 million), distillers dried grains ($415 million), and rice ($262 million). Mexico was also the second or third largest market for 25 other major commodity groups ranging from bulk commodities like soybeans ($1.8 billion) and wheat ($662 million), to intermediate goods like vegetable oils ($311 million) and malt ($210 million), and finally a wide range of high-value, consumer-oriented products like pork and pork products ($1.3 billion), beef and beef products ($1.1 billion), fresh fruit ($619 billion) and other prepared foods.

|

U.S. Agricultural Product Export Composition to Mexico

(January – December, Million USD) |

||||||

|

|

2014

|

2015

|

2016

|

2017

|

2018

|

2017-18

% Change |

|

Total U.S. Agricultural Exports

|

19,364

|

17,695

|

17,827

|

18,598

|

19,096

|

3

|

|

Consumer-Oriented Total

|

9,271

|

8,378

|

8,051

|

8,341

|

8,590

|

3

|

|

Dairy Products

|

1,644

|

1,280

|

1,218

|

1,312

|

1,398

|

6

|

|

Prepared Grocery Foods2

|

1,222

|

1,256

|

1,277

|

1,214

|

1,319

|

9

|

|

Pork & Pork Products

|

1,555

|

1,268

|

1,360

|

1,514

|

1,311

|

-13

|

|

Beef & Beef Products

|

1,166

|

1,092

|

977

|

979

|

1,058

|

8

|

|

Poultry Meat & Prods. (ex. eggs)

|

1,280

|

1,029

|

931

|

933

|

956

|

2

|

|

Fresh & Processed Fruit

|

704

|

679

|

613

|

690

|

745

|

8

|

|

Fresh & Processed Veg.

|

443

|

425

|

399

|

443

|

429

|

-3

|

|

Tree Nuts

|

222

|

269

|

253

|

256

|

371

|

45

|

|

Other Misc. Consumer Oriented

|

1,035

|

1,080

|

1,023

|

1,000

|

1,003

|

0

|

|

Intermediate Products Total

|

4,091

|

3,942

|

4,065

|

4,062

|

3,939

|

-3

|

|

Soybean Meal

|

848

|

800

|

801

|

579

|

665

|

15

|

|

Sugar, Sweeteners, Bev. Bases

|

630

|

633

|

621

|

665

|

649

|

-2

|

|

Distillers Grains

|

374

|

346

|

356

|

374

|

416

|

11

|

|

Planting Seeds

|

238

|

251

|

298

|

265

|

247

|

-7

|

|

Animal Fats & Veg Oils

|

695

|

678

|

664

|

626

|

544

|

-13

|

|

Other Intermediate

|

1,306

|

1,234

|

1,325

|

1,553

|

1,418

|

-9

|

|

Bulk Commodities Total

|

6,002

|

5,376

|

5,710

|

6,194

|

6,567

|

6

|

|

Corn

|

2,255

|

2,302

|

2,550

|

2,645

|

3,061

|

16

|

|

Soybeans

|

1,817

|

1,432

|

1,462

|

1,574

|

1,822

|

16

|

|

Wheat

|

857

|

651

|

612

|

852

|

662

|

-22

|

|

Cotton

|

411

|

332

|

340

|

404

|

372

|

-8

|

|

Rice

|

325

|

284

|

266

|

292

|

268

|

-8

|

|

Other Bulk Commodities

|

337

|

375

|

480

|

427

|

382

|

-11

|

|

Data Source: U.S. Census Bureau Trade Data, BICO-HS10

|

||||||

Growth Opportunities

Mexico will remain an important and growing export market for U.S. agricultural products as its economy and middle class develops and expands. U.S. exports of prepared grocery foods grew by nearly $100 million over the last 5 years. Key items include snack foods ($320 million), condiments & sauces ($215 million), soups ($210 million), and other processed foods. This increase is expected to parallel the growth of Mexico’s retail food and beverage sectors. Retail food sales in Mexico were valued at $159 billion in 2018 and the sector is projected to grow by 32 percent to over $200 billion by 2024, according to IHS Markit data. Non-alcoholic beverage sales were $20 billion in 2018 and expected to surpass $26 billion by 2024. Alcoholic beverage sales were nearly $19 billion in 2018, with beer accounting for 75 percent of the total and projected to grow by nearly 29 percent by 2024. Overall, as Mexico’s economy continues to develop and the number of middle-class households increases, Mexico will remain an important and growing export market for U.S. agricultural products.

1 IHS Markit consumer market projection

2 Prepared Grocery Foods include breakfast cereals, condiments & sauces, snack foods, and prepared foods.