Diverse Export Opportunities for Food & Beverage Trade with Canada

Contact:

Link to report:

Executive Summary

The Canadian market offers opportunities for food and beverage producers to highlight important production attributes unique to their products. Consumers in Canada increasingly demand more transparency about the origin of food and beverages in their diets and the production practices used to grow and manufacture them. In conjunction with growing awareness about sustainability, Canadian consumption patterns are also trending toward healthier foods. These underlying demand shifts are supported by a relatively high disposable income which encourages retail outlets to diversify their selection. There is also an increasing demand for diverse flavors from a range of cuisines, which is in part a result of increased immigration. This combination of factors, along with geographic proximity, provides opportunities for imported specialty products from the United States and makes Canada an excellent market for new-to-export and smaller companies seeking to grow their businesses.

Agricultural Product Exports to Canada

Overall U.S. exports of agricultural products to Canada were valued at $28 billion in 2023. Consumer-oriented products including fruits and vegetables, meats, dairy, processed food, and beverages constituted 72 percent of that trade with a value of $20 billion. Additionally, U.S. seafood exports to Canada topped $1 billion in 2023.

Table 1: Top U.S. Consumer-Oriented Food Exports to Canada (2019-2023)

| Value Million U.S. Dollars | |||||

| 2019 | 2020 | 2021 | 2022 | 2023 | |

| Bakery Goods, Cereals, & Pasta | 2,227 | 2,272 | 2,314 | 2,704 | 2,768 |

| Fresh Vegetables | 1,986 | 1,900 | 1,992 | 2,105 | 1,958 |

| Fresh Fruit | 1,484 | 1,585 | 1,744 | 1,716 | 1,702 |

| Non-Alcoholic Bev. (excl. juice) | 1,213 | 1,191 | 1,184 | 1,309 | 1,458 |

| Food Preparations | 1,052 | 1,196 | 1,221 | 1,324 | 1,359 |

| Dairy Products | 728 | 736 | 855 | 1,030 | 1,082 |

| Chocolate & Cocoa Products | 713 | 757 | 809 | 844 | 878 |

| Beef & Beef Products | 654 | 727 | 773 | 836 | 877 |

| Pork & Pork Products | 802 | 854 | 953 | 867 | 876 |

| Condiments & Sauces | 646 | 660 | 704 | 775 | 839 |

| Other Consumer-Oriented Products | 5,189 | 5,216 | 5,658 | 6,457 | 6,415 |

| Total Consumer-Oriented Ag Products | 16,694 | 17,094 | 18,207 | 19,967 | 20,212 |

Note: Column totals may not add up exactly due to rounding.

Source: U.S. Census Bureau Trade Data via FAS/GATS

Canada ranks as the top export market for 16 of the 25 consumer-oriented categories and 2nd ranked in four other categories, solidifying its standing as the most diverse U.S. export market as well. Nearly all consumer-oriented categories have seen steady to strong export growth over the past 5 years in Canada. From fresh fruits and vegetables to packaged ready-to-eat meals and snacks, there are opportunities for U.S. exporters. The top consumer-oriented export category to Canada last year was bakery goods, cereals, and pasta with nearly $2.8 billion in sales, an increase of 24 percent since 2019. Exports of food preparations – which include soups and other canned or frozen meal preparations – to Canada have grown from just under $1 billion in 2018 to nearly $1.4 billion in 2023, a 29 percent increase. This trend was driven in part by the pandemic as consumers ate more meals at home. Seafood exports to Canada have experienced some year-to-year variations based on price fluctuations but have averaged $1.1 billion during the past 5 years driven by a wide variety of species. Condiment and sauce exports topped $839 million in 2023, a 24-percent increase spanning 5 years. Growth in this category has been led by mixed seasoning condiments, salad dressings, and sauces, which offset declining exports of ketchup. Meanwhile, processed vegetable exports (including French fries, pickles, and other canned and frozen vegetables) were nearly $730 million. Processed fruit exports to Canada increased 16 percent during the previous 5 years to $590 million. This category is led by mixed fruits and nut snacks valued at nearly $108 million in 2023, as well as jams and jellies with exports of $64 million. Canadian indulgence for sweets in the cold north remains strong, as chocolate and cocoa product exports have grown by 23 percent from $713 million to $878 million spanning the last 5 years. Confectionery exports are also up 41 percent to over $447 million.

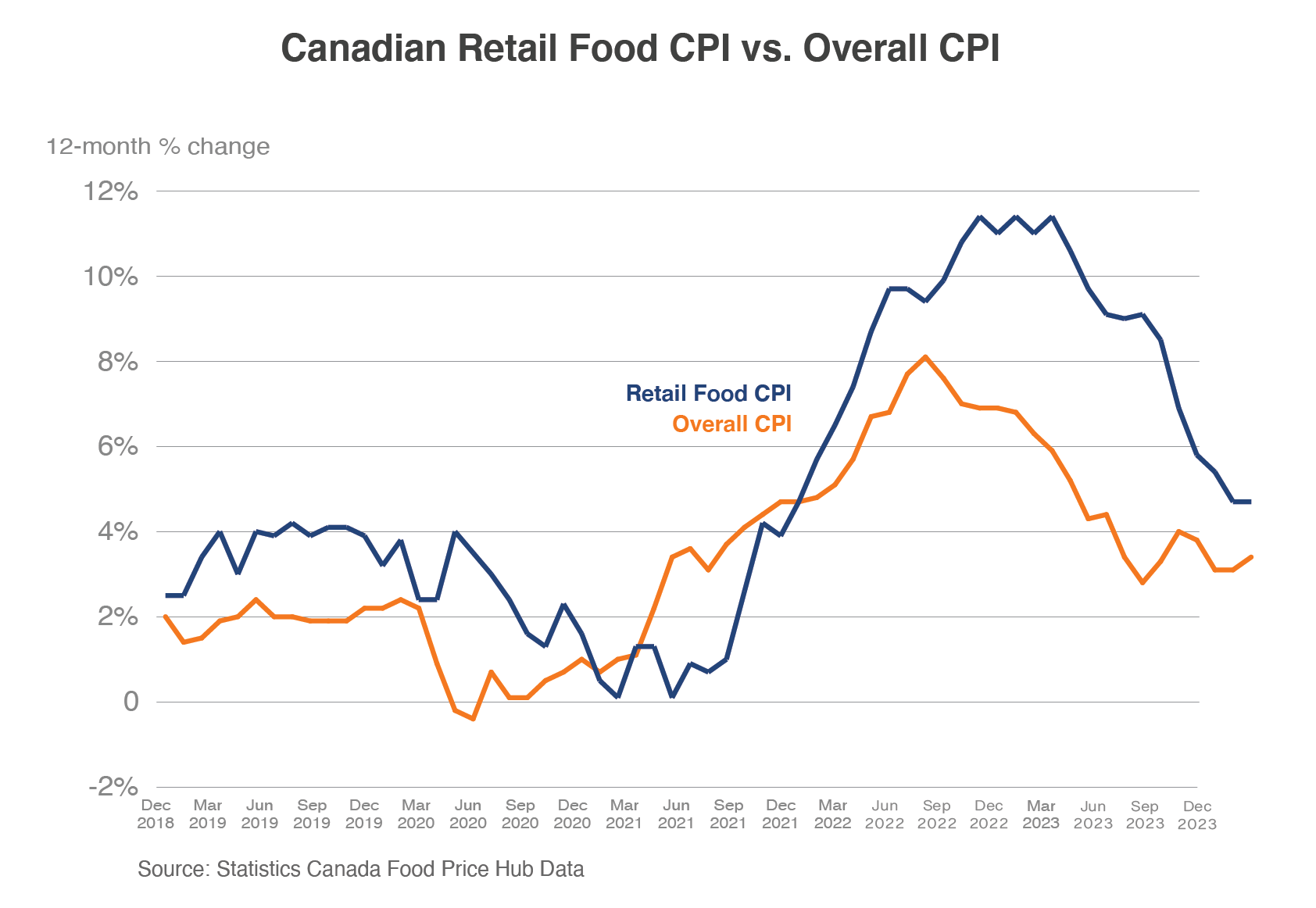

Economic & Consumption Trends

Inflation and the increased cost of living have been significant story lines during the past 2 years. High food price inflation, as well as overall inflation, in particular housing, have resulted in more price-conscious shopping. While the shift toward budget shopping is most pronounced in lower and fixed income consumer segments, middle-income shoppers have also shifted spending habits. Euromonitor International reports that discount retailers benefited most as consumers sought out affordable groceries. Canadian discount chain Dollarama expanded its store network from 1,444 to 1,525 outlets and reported a 20 percent inventory turnover increase in the second quarter of 2023, compared with the same period in 2022, despite increasing its price point. On a positive note, inflation has declined from 2022 and early 2023 highs. The Consumer Price Index (CPI) for retail food purchases declined from 11.4 percent in January 2023, to 4.7 percent in December 20231. Looking forward, overall inflation is expected to continue to decline through 2024, approaching the Bank of Canada’s target range. This decline will be welcomed relief to consumers and specialty food retailers alike.

The overall economic outlook is flat for Canada in 2024, with S&P Global Market Intelligence forecasting real GDP growth of 0.8 percent, down from the 1.1 percent increase in 2023. However, by 2025, S&P is projecting real GDP growth to pick up to 1.7 percent, as the Bank of Canada loosens its restrictive monetary policy when inflation concerns abate. The exchange rate is also expected to become a bit more favorable for imports as the economy picks up as well. The Canadian dollar ended 2023 year at C$1.32/US$, strengthening slightly from C$1.36/US$ in 2022. The exchange rate forecast in the coming years is expected to improve for importers as the Canadian dollar is expected to continue strengthening to drop below C$1.30/US$.2

Demographic Trends

The vast majority of Canada’s population, approaching 40 million, live within 100 miles of the U.S. border. Consumers are concentrated among a handful of metropolitan areas. Canada’s three largest cities – Toronto, Montreal, and Vancouver – are in the provinces of Ontario, Quebec, and British Columbia, respectively, and account for 75 percent of national economic activity. Projections show that the population will grow by 15 percent in the next 20 years, driven predominantly by immigration and declining birth rates. In 2023, Canada welcomed over 447,055 immigrants, from 175 countries – a record for a single year. The Government will continue their effort to grow the economy through immigration, by welcoming an estimated 451,000 permanent residents in 2024. The top foreign countries from where immigrants originate are India, China, Afghanistan, Nigeria, and the Philippines. Declining birth rates and increasing life expectancy will continue to push up the median age from its current 41.7 years.3

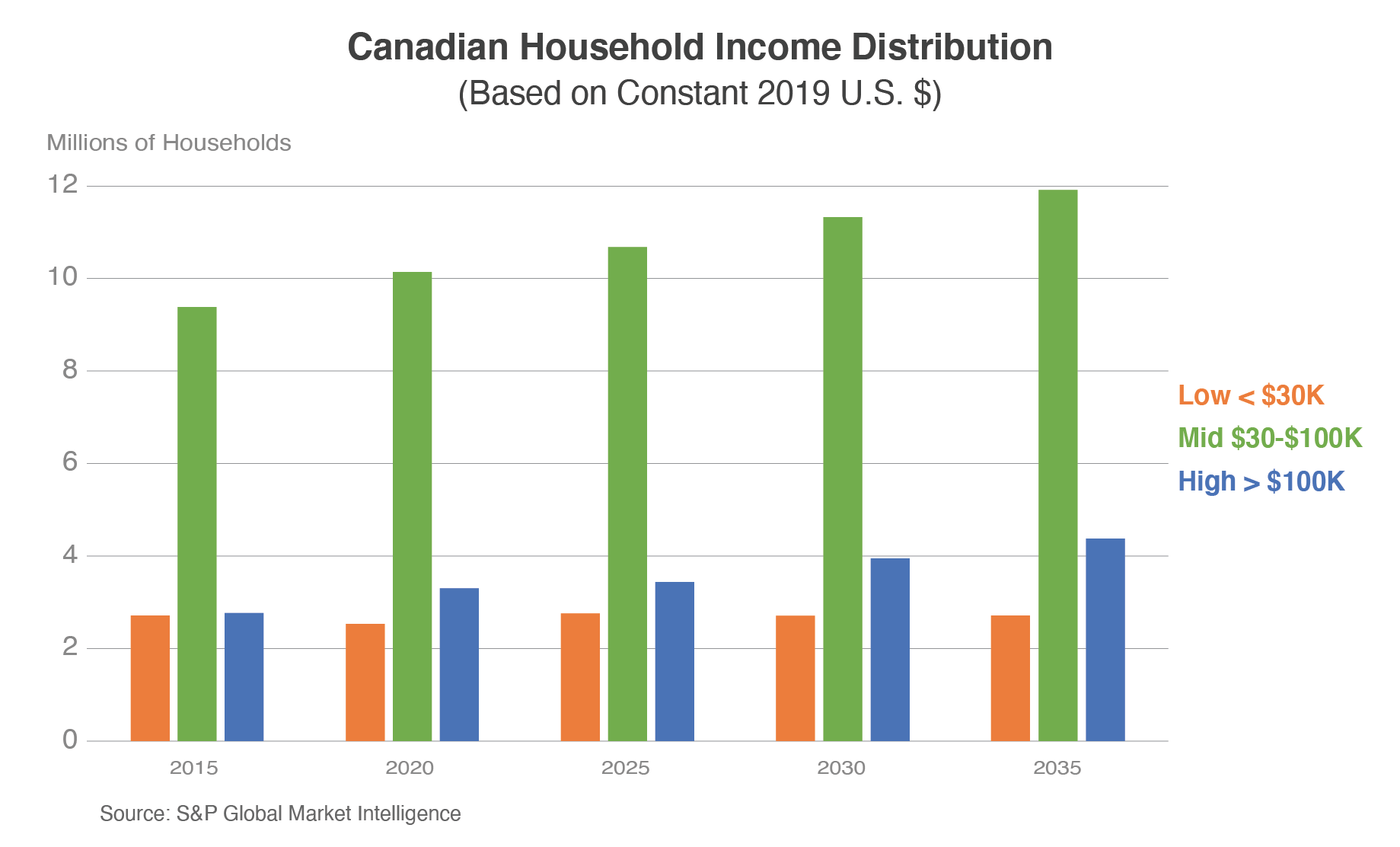

Canada is expected to continue building a strong middle class as more families move out of the lower-income bracket. According to S&P Global, there were 9.4 million middle-income households in 2015, which rose to 10.5 million in 2023 and is projected to increase to 12 million by 2035. Families moving from lower-income to middle-income classes have an opportunity to diversify their diets and purchase more meats and seafoods and other specialty products. The number of upper-income households is also expected to increase from 3.3 million in 2023 to 4.4 million households by 2035, which will provide growth opportunities for producers specializing in higher-end foods and beverages.

Growing Demand for Healthy & Sustainably Sourced Food & Beverages

Demand for health and wellness foods is increasing across all age groups in Canada. This demand is driven in part by efforts to curb obesity, as well as greater post-pandemic health consciousness. There is a greater demand for naturally healthy, whole-grain products and organic specialty foods, as well as reduced-sugar, low-calorie, high-protein snack foods. Naturally healthy foods include products that improve health and wellbeing beyond the product’s pure calorific value (such as high fiber foods, nuts, seeds and trail mixes, honey, whole grain products, fruit, and nut bars). Canadian demand for organic packaged food is also growing. Part of the naturally healthy dynamic includes a trend of increasing demand for plant-based proteins. According to Mintel Research, 75 percent of consumers would like to include additional plant-based protein products in their diets. Another growing segment of the overall increased sales of healthy foods is driven by greater demand for “free from” products (e.g., gluten-free, dairy-free).

Canadian consumers are increasingly making purchases with sustainability in mind. Increased environmental awareness is driving demand for sustainably produced- and packaged products in Canada. Euromonitor International surveyed consumers on their values and behavior in Canada and found that 60 percent of respondents try to positively impact the environment through everyday actions. Canadians are also shopping for ethically or eco-conscious products. Millennials and Generation Z are roughly twice as likely as Generation X and Baby Boomers to respond that buying these products feels good. This grassroots awareness is coupled with government programs to improve sustainability, such as Canada's Zero Plastic Waste initiative. Federal, provincial, and territorial governments adopted a Canada-wide Action Plan on Zero Plastic Waste to implement the strategy. The strategy includes developing targets, standards, and regulations toward eliminating plastic pollution. Retailers are actively working to make supply chains and packaging more sustainable, including a shift away from plastic checkout bags and other single-use items.

Conclusion

In summary, Canadian consumers have a relatively high disposable income and are well positioned to purchase high-quality products. Most Canadians trust U.S. food and agricultural products because the countries have similar food safety standards. Canadian food consumption patterns are becoming healthier and increasingly driven by sustainability goals. A growing population driven by increased immigration is leading to a growing demand for diverse flavors and greater access to niche cuisines. As a result, retailers and distributers are continually looking for new and innovative brands, which provides opportunities for imported specialty products. These combined factors make Canada an excellent market for new-to-export and smaller companies seeking to grow their businesses.

1 Consumer Price Index for food purchases from Statistics Canada

2 Economic data and forecasts from S&P Global Market Intelligence compiled on Jan. 15, 2024

3 USDA/FAS - Canada Exporter Guide