Rice 2020 Export Highlights

Top 10 Export Markets for U.S. Rice(values in million USD) |

|||||||

| Country | 2016 | 2017 | 2018 | 2019 | 2020 | 2019-2020 % Change | 2016-2020 Average |

| Japan | 234 | 190 | 232 | 275 | 261 | -5% | 238 |

| Mexico | 266 | 292 | 268 | 278 | 245 | -12% | 270 |

| Haiti | 190 | 237 | 206 | 206 | 245 | 19% | 217 |

| Canada | 148 | 148 | 175 | 194 | 194 | 0% | 172 |

| South Korea | 105 | 85 | 89 | 120 | 162 | 34% | 112 |

| Saudi Arabia | 92 | 88 | 73 | 98 | 105 | 7% | 91 |

| Jordan | 73 | 90 | 66 | 73 | 77 | 5% | 76 |

| Colombia | 58 | 51 | 54 | 49 | 65 | 33% | 55 |

| Honduras | 71 | 45 | 61 | 47 | 45 | -4% | 54 |

| Brazil | 1 | 0 | 1 | 0 | 38 | 21172% | 8 |

| All Others | 546 | 483 | 453 | 510 | 440 | -14% | 486 |

| Total Exported | 1,784 | 1,709 | 1,678 | 1,850 | 1,877 | 2% | 1780 |

Source: U.S. Census Bureau Trade Data - BICO HS-10

Highlights

In 2020, the value of U.S. rice exports to the world was $1.9 billion, up 1.5 percent from the prior year. The top three markets, accounting for 40 percent of exports, were Japan at $261 million, Mexico at $245 million, and Haiti at $245 million. U.S. exports to Mexico declined as South American suppliers expanded market share in that primarily paddy market. Countries where the United States has free trade agreements remained significant markets, particularly in the Western Hemisphere.

Drivers

- U.S. rice export value rose 1.5 percent based on higher unit values, despite lower volumes.

- Commercial exports to Haiti expanded, both in terms of volume and unit value.

- Exports to Brazil were the highest since 2003, due to Brazil’s tightening supplies prompting increased imports.

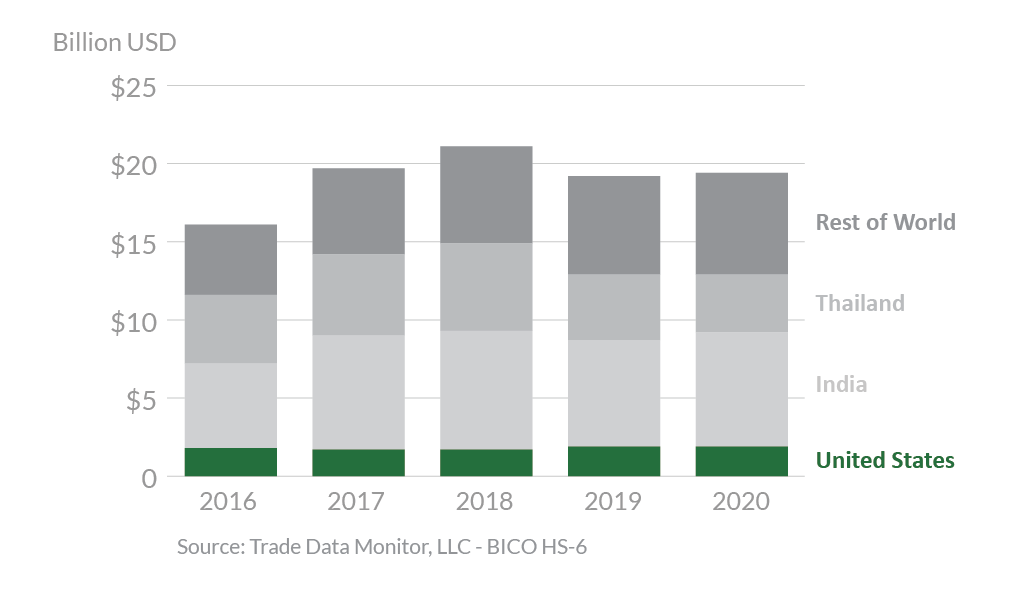

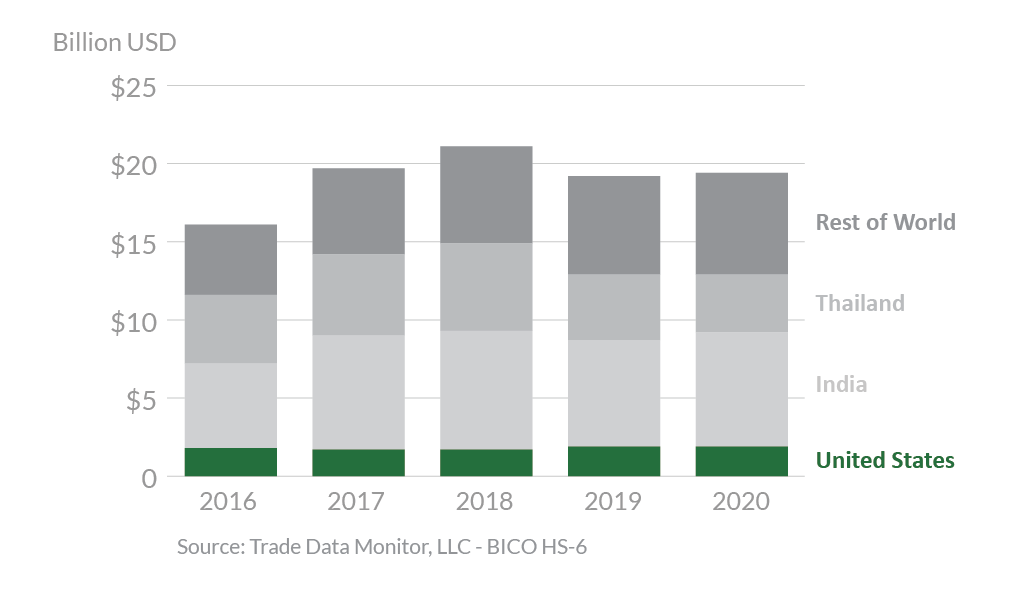

Global Rice Exports

Looking Ahead

Looking ahead to 2021, exports are forecast higher despite smaller production forecasts for 2021-2022. Demand for U.S. rice is expected to remain strong in core markets such as Mexico and Haiti. The outlook is favorable for maintaining a strong market presence in countries with free trade agreements such as Colombia, Central America, and the Dominican Republic. Exports for U.S. medium-grain rice, especially to East Asian markets such as Japan and South Korea, are forecast to remain steady. U.S. prices remain high relative to Asian prices, making it challenging to compete in price-sensitive markets including Africa and Southeast Asia. Thai and Vietnamese export prices are expected to decline amid the new harvest, while Indian export prices remain very low in comparison to other suppliers.