USDA Estimates of India’s Cotton in Line with Local Estimates

Contact:

Link to report:

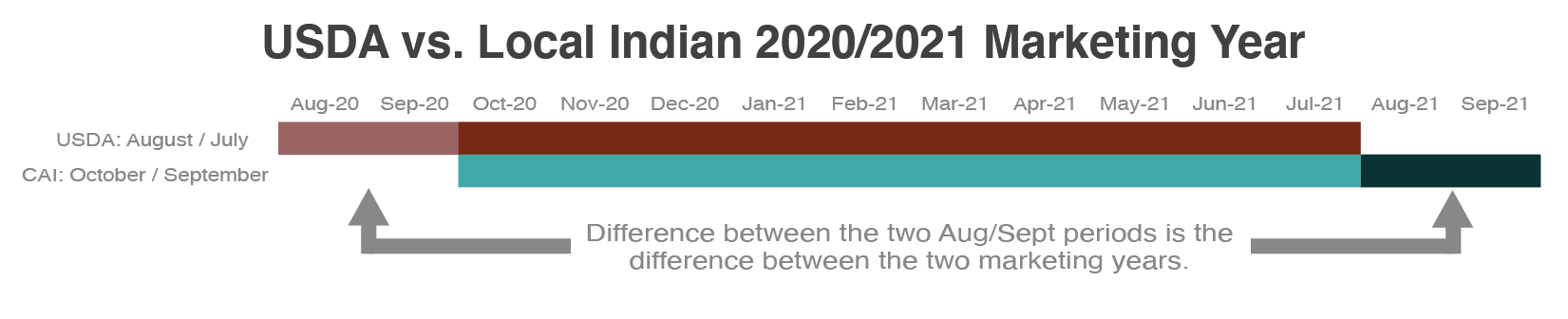

USDA estimates and forecasts for cotton supply and demand are on an August-July marketing year (MY) for all countries, while estimates published by many governmental or private groups in other countries are based on local MYs. The local MY for India is October-September. This difference can make comparing what are nominally the same estimates (i.e., MY 2020/21) difficult, especially for marketing year beginning and ending stocks.

Use and production estimates are relatively easier to compare. By definition, estimates of use based on different MYs will vary. The USDA estimate of use in India for the 2020/21 MY is for the period August 2020 through July 2021, while an estimate based on the local MY would cover the period October 2020 through September 2021. Therefore, the two estimates, even if based on the same monthly use numbers, would not be the same. For example, the difference between the two MY 2020/21 estimates would be the difference between the use in Aug/Sept 2020 and the use in Aug/Sept 2021.

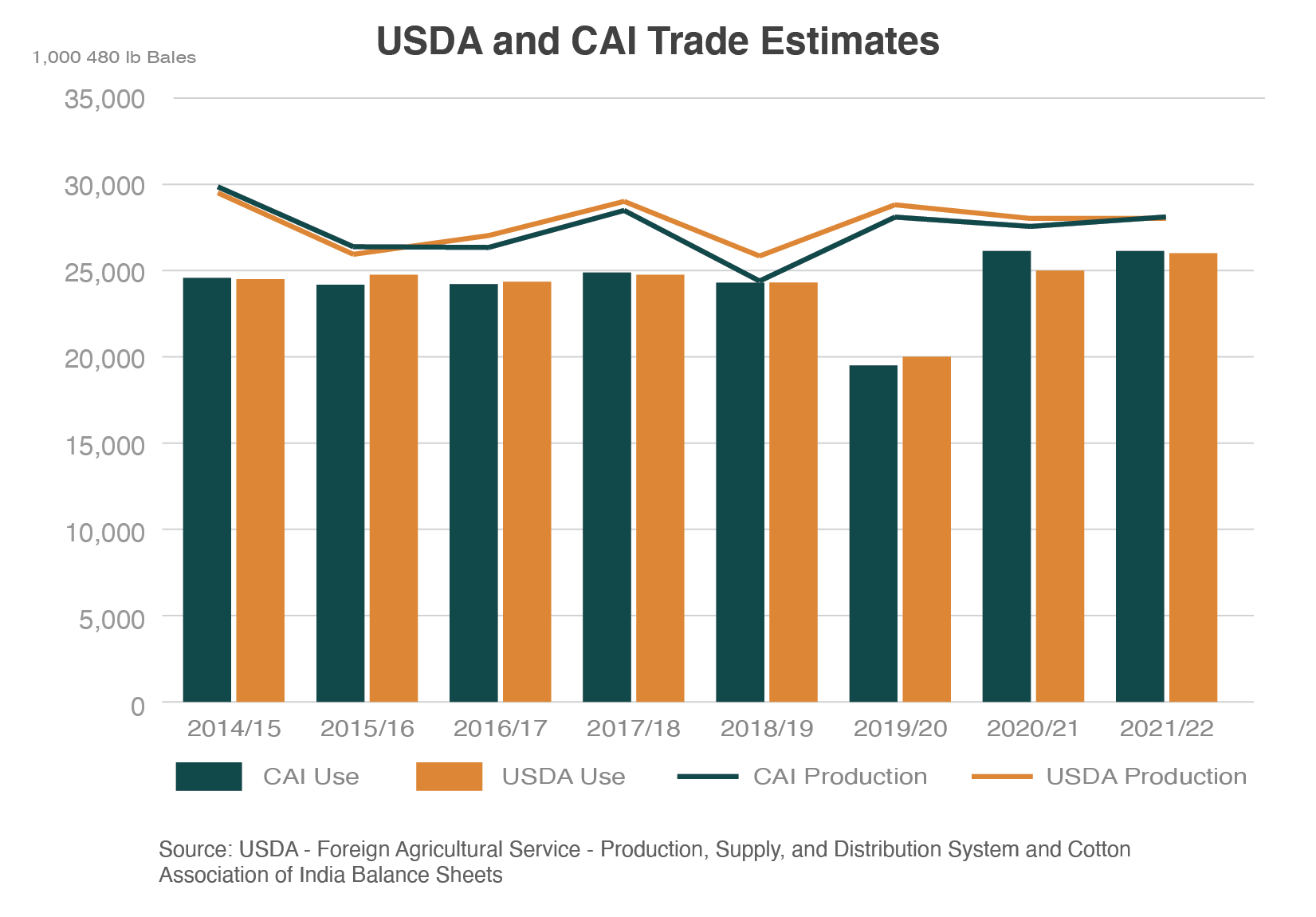

Generally, this difference is relatively minor and largely reflects growing or declining use over time. A notable exception is when a shock to use occurs in one period but not the other, such as the impacts of COVID-19. While the initial impact of COVID-19 on use in India during the period April-July 2020 is reflected in both the USDA and Cotton Association of India (CAI) MY 2019/20 estimates, the impact in the Aug/Sept 2020 period is reflected in the 2019/20 local MY, but it is reflected in the 2020/21 MY in the Aug/July USDA MY. Chart 1 highlights this by showing how close the use estimates for USDA and the CAI are for MY 2014/15-2018/19 and the relatively large differences in 2019/20 and 20/2021.

For production estimates, there is usually an identifiable crop which both USDA and local estimates place into a single MY; thus production forecasts are directly comparable. This is the case for India where the USDA Aug/July MY and the local Oct/Sept MY capture the same production. So, production estimates for India are directly comparable between USDA and local MYs and any differences between them represent varying estimates for the size of a particular crop.

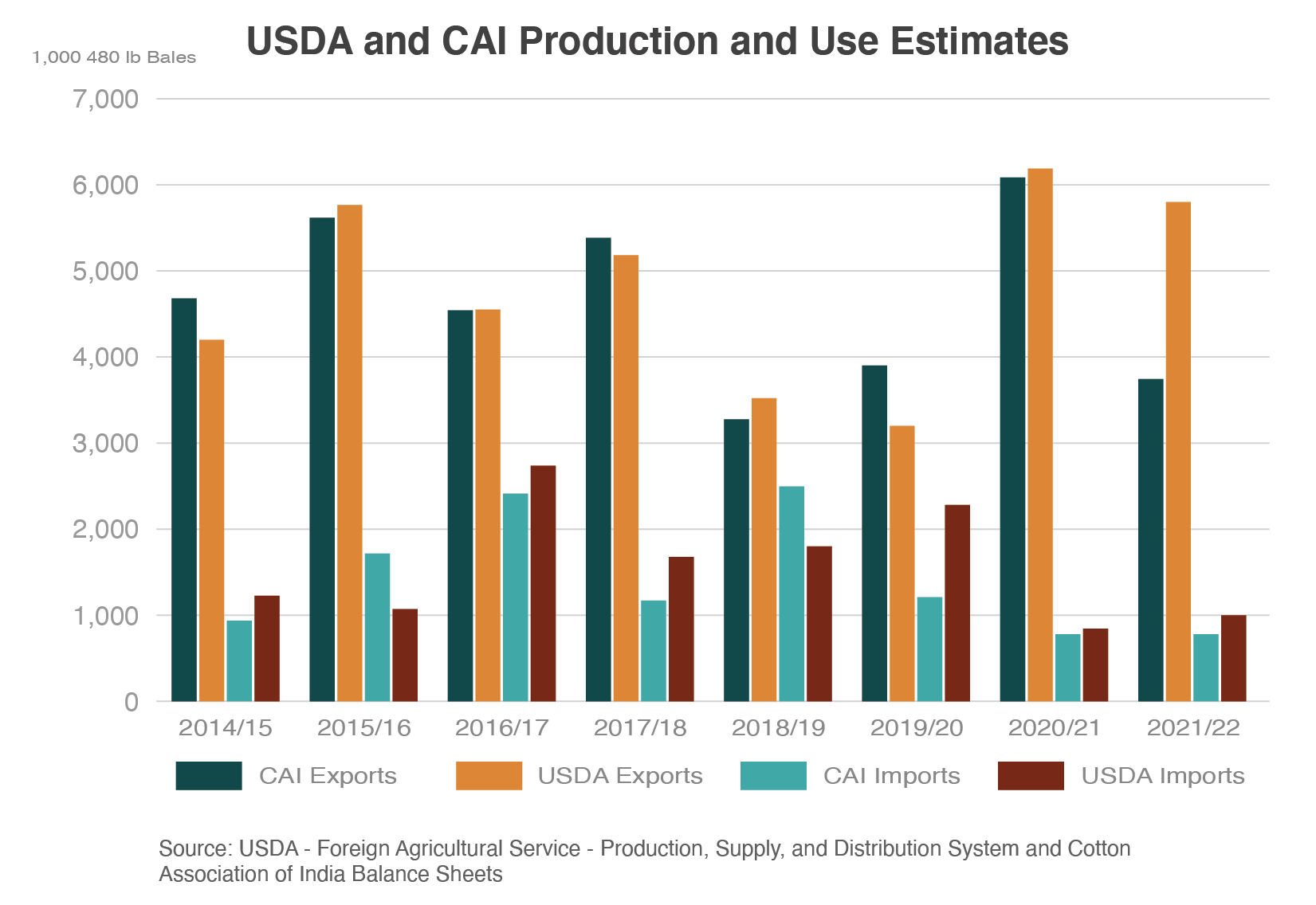

As with the use estimates, the trade estimates based on different MYs differ by the months not contained in both definitions. USDA and local MY trade estimates may have more substantial differences as there is often greater volatility in the levels of monthly trade than use. Over time, however, these differences are largely offsetting. This is especially true in India where in the last 10 years, the Aug/Sept share of total MY imports have ranged from 3 to 52 percent and for exports from 2 to 10 percent, resulting in a wider variance between USDA and local estimates of trade (Chart 2).

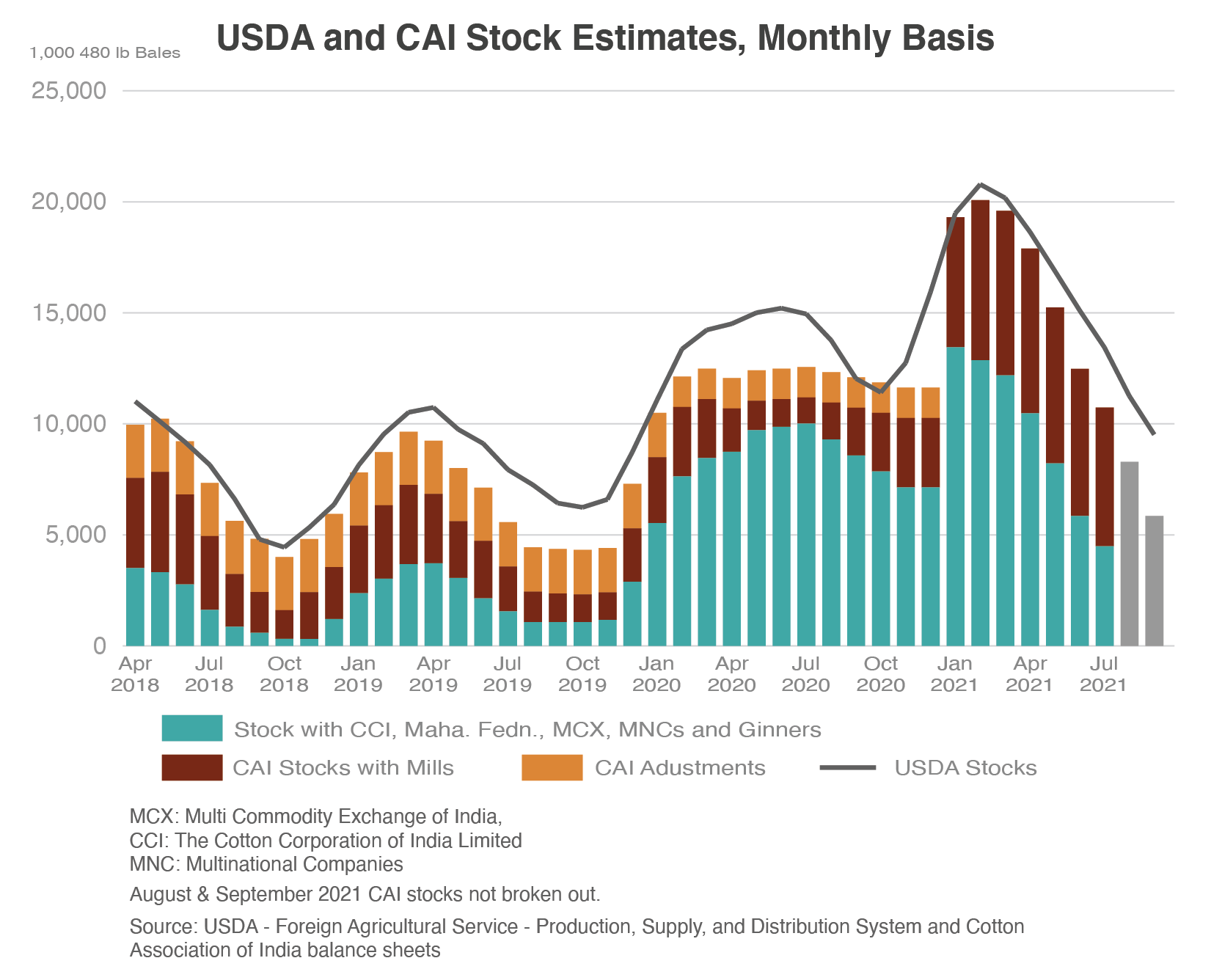

Another factor which leads to difficulties in comparing USDA estimates to others is that USDA uses a balance sheet methodology where—by definition—ending stocks in one MY must equal beginning stocks in the next MY. Not all balance sheets do this. For example, CAI publishes balance sheets for individual MYs, but often makes adjustments to beginning stocks in one MY without making adjustments in the previous MY. The result is that the ending stock in one MY does not necessarily equal the beginning stock in the next MY. Table 1 shows the CAI balance sheets for the last seven MYs with the adjustments made each season. This makes it difficult to compare CAI balance sheet estimates for ending stocks to USDA estimates, even after factoring in the effects of the differences in MY time periods for production, use, and trade discussed above.

| Table 1: Cotton Association of India Estimates (Oct/Sept MY) (1,000 480 lbs Bales) |

||||||||

| MY | Beginning Stocks | Production | Imports | Total Supply | Total Use1 | Exports | Closing Stock2 | Adjustment to Beginning Stocks |

| 2014-15 | 4,200 | 29,855 | 936 | 34,991 | 24,570 | 4,680 | 5,741 | 0 |

| 2015-16 | 5,246 | 26,345 | 1,716 | 33,306 | 24,180 | 5,616 | 3,510 | -495 |

| 2016-17 | 2,847 | 26,306 | 2,413 | 31,566 | 24,212 | 4,540 | 2,813 | -663 |

| 2017-18 | 2,808 | 28,470 | 1,170 | 32,448 | 24,882 | 5,382 | 2,184 | -5 |

| 2018-19 | 2,574 | 24,336 | 2,496 | 29,406 | 24,297 | 3,276 | 1,833 | 390 |

| 2019-20 | 2,496 | 28,080 | 1,209 | 31,785 | 19,500 | 3,900 | 8,385 | 663 |

| 2020-21 | 9,750 | 27,651 | 780 | 38,181 | 25,740 | 6,006 | 6,435 | 1,365 |

| 2021-22 | 6,435 | 28,090 | 780 | 35,305 | 26,130 | 3,744 | 5,431 | 0 |

| 1 Mill Consumption, Consumption by SSI Units, and Non-Mill Use 2 Stock with Mills and Stock with CCI, MNCs, MCX & Ginners |

||||||||

Looking at CAI’s adjustments to stocks, assuming that CAI’s estimates for MY 2019/20 production, use, and trade are correct, then the 1.365 million bales added to 2020/21 beginning stocks were also in stocks at the beginning of 2019/20. The same logic can be applied to the adjustments in prior MYs, resulting in a total of 2.4 million additional bales above CAI's published ending stocks for MY 2017, and smaller additions to the following 3 years.

Chart 2 below shows monthly stock estimates for both adjusted CAI and USDA estimates. Unofficial monthly stocks for USDA are calculated from the USDA Production, Supply and Distribution MY numbers using various monthly data from sources in India, Ministry of Commerce & Industry for imports and exports, Textile Commissioner’s Office for use, and CAI and Cotton Corporation of India for arrivals. The CAI monthly stocks are based on published monthly information. Adding in the adjustments described above to beginning stocks allows for a direct comparison of USDA and CAI stock numbers.

Chart 3 shows that from April 2018 through March 2019, the stock estimates are virtually the same. CAI stocks decline relative to USDA stocks from April 2019 but line up closely in January, September, and October 2020; and in January 2021. Despite the seemingly large differences between USDA and local estimates of India stock levels, a closer examination reveals that there are only minor differences between the production, use, and trade estimates. The difference in methodology accounts for a large portion of the difference in estimates of stocks over time.

While adjusting for the use of different marketing years is important when comparing estimates for a specific marketing year, understanding the differences in methodologies used becomes critical when comparing estimates over several marketing years.