U.S. Agricultural Export Prospects in Angola

Contact:

Link to report:

Executive Summary

Located on the west coast of southern Africa, Angola borders the four nations of the Democratic Republic of the Congo, the Republic of the Congo, Namibia, and Zambia. Approximately 10 percent of arable land is used for agriculture, with food production falling short of consumer demand, making Angola reliant on imports to meet its needs. As Angola works on building infrastructure, agricultural production will increase as the nation is home to seven of Africa’s ecosystems and can produce a wide variety of agricultural goods. Food is sold in formal and informal markets throughout Angola, with modern retail gaining popularity in the urban regions located in the west coast port cities like the capital city of Luanda. Luanda is the location of Angola’s largest deep-water port, capable of receiving large shipments of major goods. Since the end of Angola’s civil war in 2002, governance has remained constant, and macroeconomic stability has been improved through flexible exchange rates, secure monetary policy, fiscal consolidation, and central bank autonomy in recent years.

Macroeconomic Overview

In 2022, Angola’s per capita, constant 2015 U.S. gross domestic product (GDP) was $2,299.1 Angola is a lower-middle-income nation, mostly because of the large income disparity between the impoverished majority of the nation and the small population of exceptionally high-income earners connected with the oil industry. As an oil exporter, Angola’s currency is fairly stable because it is tied to global oil demand. Angola is a member of the Organization of the Petroleum Exporting Countries, the intergovernmental organization regulating the supply of oil and thus influencing global commodity prices. Higher oil prices in 2022 sparked an increase in public investments and an appreciation of the domestic currency by 27 percent since 2021. This kind of increased oil income generates consumption growth as well as government investment in agriculture and industry. Agriculture accounted for approximately 10 percent of Angola’s 2021 GDP, providing both formal and informal employment.2 In the medium term, oil production is declining, and job reliance on the petroleum industry will lead to higher unemployment rates. High poverty in Angola is attributed to the high level of income inequality due to the oil industry’s structure as well as a lack of quality jobs. According to the World Bank, 80 percent of informal and formal employment is linked to subsistence work, and unemployment in urban (50 percent) and youth (38 percent) populations has remained high.

Angola has recently invested in education and health with a social registry that determines the eligibility of individuals for social programs funded by the government. One of the successful social programs is Kwenda, the cash transfer program (started in 2020), which provides adaptable income support through direct digital payments along with other human development and economic inclusion activities. These investments by the Angolan Government can reduce extreme poverty and strengthen human capital.

Long-term per capita income is forecast to increase by 20 percent in real terms by 2040, according to Euromonitor. Luxury spending patterns will be influenced by later-lifer populations, as they will remain the top-income band in 2040. Food and non-alcoholic beverages will be the primary consumer spending category in 2040, with hotels and catering forecast to have the fastest growth during the same time period. Regionally, Luanda is expected to remain the largest consumer market, making up 45 percent of total consumer expenditure in 2040.

Global Exports to Angola

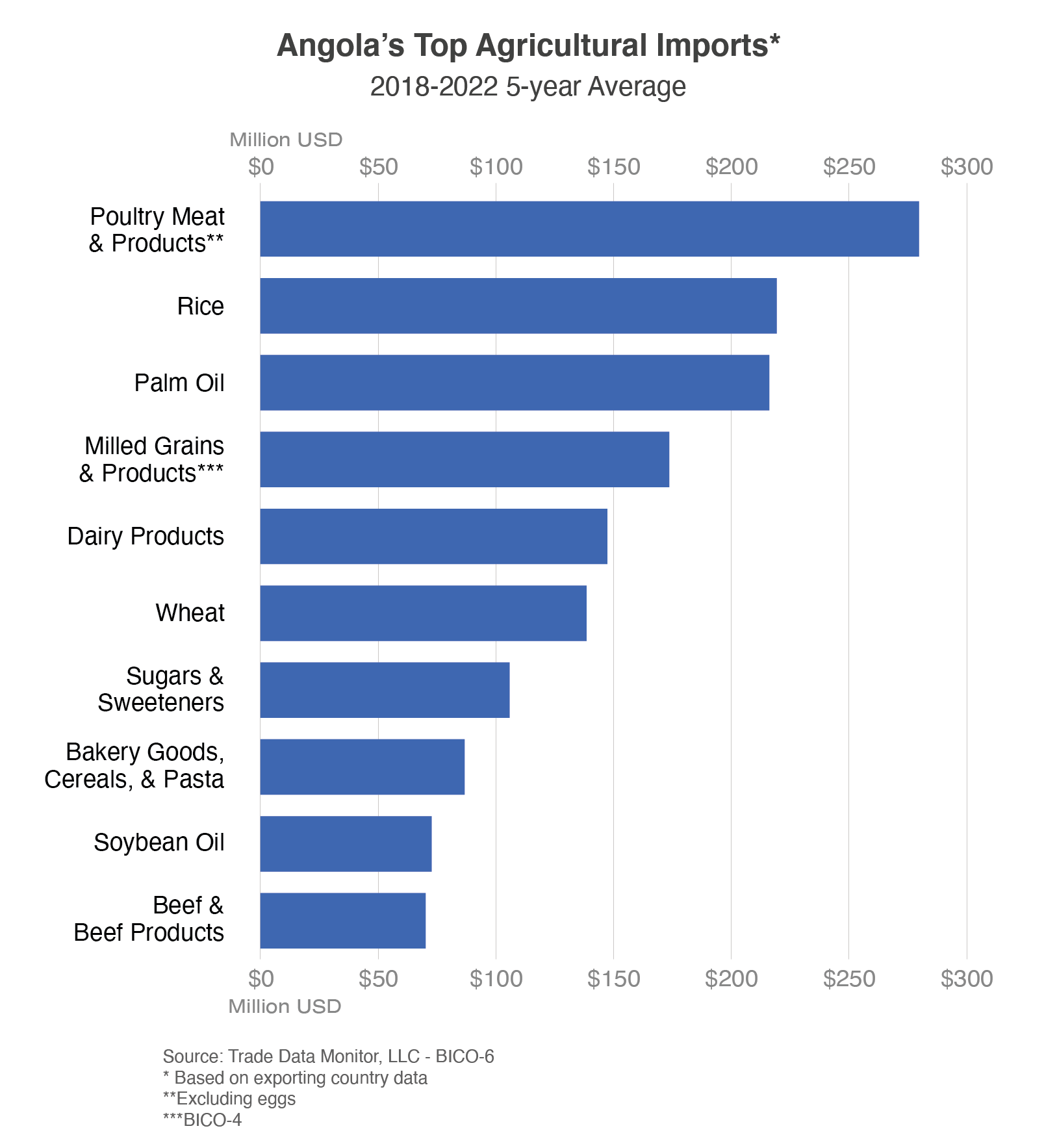

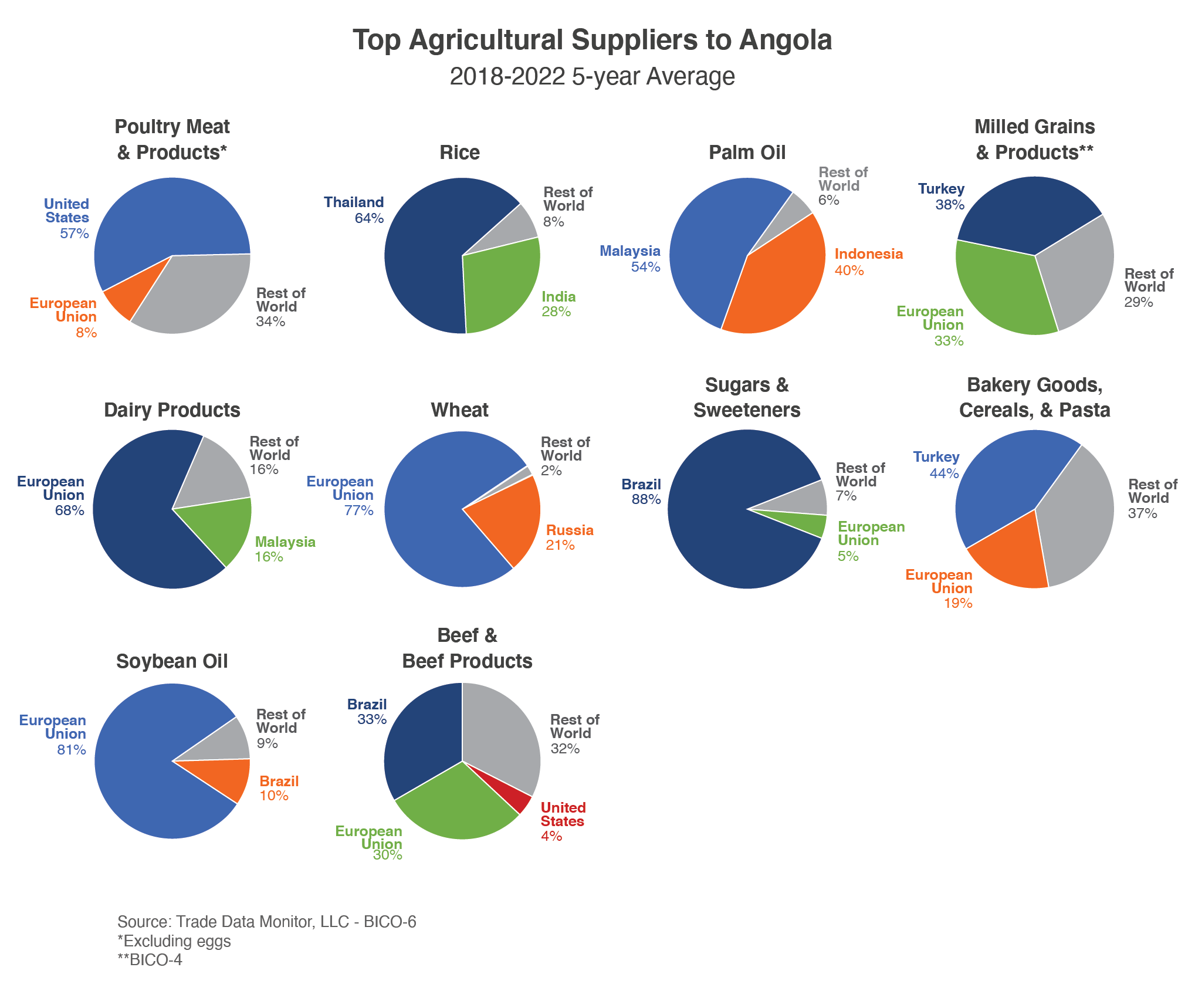

Global exports to Angola have increased 2 percent year-over-year since 2018, a $416 million difference from 2018 to 2022. The United States consistently ranks among the top five suppliers of Angola’s major imports. Having more than a 55 percent market share of the poultry export market is the primary reason the United States has been the third-largest supplier of agricultural goods during the last 5 years. The average top five agricultural exports to Angola from all sources during the past 5 years are poultry meat and products ($280 million), rice ($219 million), palm oil ($216 million), milled grains and products ($174 million), and dairy products ($147 million). On a 5-year average, the European Union (EU) ranks within the top 2 suppliers in 8 out of the top 10 agricultural goods globally exported to Angola. The EU remains a top competitor in wheat, dairy, soybean oil, milled grains, poultry, beef, bakery goods/cereals/pasta, and sugars and sweeteners. As Angola looks to expand its import infrastructure, diversify its agricultural commodity options, increase its cold and dry storage capacity, and develop transportation infrastructure throughout the country, the United States has opportunities to establish connections with Angola and other communities in sub-Saharan Africa.

U.S. Agricultural Trade

During the past 5 years, U.S. exports to Angola have had a growth rate year-over-year of 2 percent in value. In 2022, the United States exported approximately $238 million in agricultural products to Angola, an 86-percent increase from 2021 and a 23-percent increase from 2018. For more than 10 years, the United States has been one of the top agricultural suppliers to Angola, coming in third behind the EU ($755 million) and Brazil ($468 million) in 2022.

Historically, the food retail market had been dominated by Portuguese, Lebanese, and Indian suppliers, but with South African supermarket chains expanding into Angola, retailers are now able to carry frozen goods as well as the typical dry goods, while other supermarkets carry quality fresh produce and focus their market on the top Angolan income-earners. This shift in retail atmosphere opens great opportunity for high-quality U.S. agricultural goods.

Poultry

Total 2022 Angolan Poultry Imports from World: $436 million

2018/22 Percent Change of Angola’s Imports from U.S.: +27%

Global Annual Growth Rate: +6%

Source: Trade Data Monitor

In 2022, Angola was the sixth-largest export market for U.S. poultry, with exports reaching more than $230 million. The United States was the number one supplier of poultry meats and products to Angola and held more than 53 percent of the market share in 2022. Even as Angola has increased domestic production of poultry, import demand is not set to decrease as feed costs, a lack of veterinary medicine, and the embargo of genetically engineered (GE) feed products all prevent substantial expansion of domestic poultry production.3

Wheat

Total 2022 Angolan Wheat Imports from World: $206 million

2018/22 Percent Change of Angola’s Imports from U.S.: +/- 0%

Global Annual Growth Rate: +28%

Source: Trade Data Monitor

Domestic wheat milling has been expanding since 2017 in Angola, but Angola still falls short of wheat production, leaning heavily on imports to meet domestic demand.4 In 2022, Angola imported 167 percent more wheat than in 2018, a $34-million increase. The EU is the main supplier of wheat to Angola, with only seven suppliers total in the past 5 years. The United States supplied more than $3 million in wheat in 2019, and since then there have been no imports of U.S. wheat. As Angola’s wheat milling capabilities increase, the United States has ample export opportunity if wheat becomes more price competitive, especially U.S. hard red winter wheat, which is used to make the Lebanese-style breads in Angola. The major demand is for grains that can be processed in the country.

Pulses

Total 2022 Angolan Pulses Imports from World: $21 million

2018/22 Percent Change of Angola’s Imports from U.S.: -64%

Global Annual Growth Rate: -17%

Source: Trade Data Monitor

During the past 5 years, Canada has been the number one supplier of pulses to Angola. Overall, there have been decreased exports of pulses to Angola ($21 million decrease in 2022 compared to 2018), along with decreased purchases from the United States. In 2022, U.S. pulse exports to Angola was

$667 thousand, compared to almost $2 million in 2018. With more involvement, the United States has an opportunity to increase market share, especially since exports have a trend toward coming from North America.

Wine

Total 2022 Angolan Wine & Related Products Imports from World: $63 million

2018/22 Percent Change of Angola’s Imports from U.S.: +79%

Global Annual Growth Rate: -2%

Source: Trade Data Monitor

In 2022, the United States was the third-largest supplier of wine and related products. The top competitors were the EU ($59 million) and South Africa ($2 million). Imports from the United States in 2022 only reached $230 thousand, but there are major opportunities as Angola moves to diversify quality product options in major cities. Demand is overwhelmingly for red wines, and as education in U.S. wine and related products increases, interest will increase from high-end restaurants and retailers.

Trade Policy

The United States and Angola signed a trade and investment framework agreement in 2009, seeking to promote trade. Angola is eligible for preferential trade benefits as part of the African Growth and Opportunity Act (AGOA).5 The AGOA trade program provides eligible countries duty-free access to the United States market for approximately 6,500 tariff line items.

Angola has been a member of the World Trade Organization since 1996 and is a member of the Southern African Development Community (SADC). Angola has applied to accede to the SADC-EU Economic Partnership Agreement. Angola ratified the African Continental Free Trade Area in 2020, one of the world’s largest free trade areas, covering 54 countries and 1.4 billion people, and which is anticipated to provide more opportunities for U.S. exporters.

Presidential Decree Number 23/19, which was issued in January 2019, identifies 54 products, mainly agricultural, for which importers must show that they have attempted to source locally before they will be granted an import permit. However, the post’s contacts indicate that the decree has not hindered trade, at least regarding the import of poultry products. The U.S. Department of Agriculture and the Office of the U.S. Trade Representative are investigating two decrees not yet enacted, but which, in sum, would mandate the affixing of high-security tax stamps on certain products, including beverages and tobacco.

For the importation of animals and animal products, seeds, and plants and their derivatives, Angola’s Ministry of Agriculture and Forestry issues import permits and veterinary health certificates. Currently, Angola does not have specific food safety laws, but a broad public health law that will address food safety and other topics is pending approval in parliament. More information on the limitations of biotechnology products and GE restrictions, along with labeling requirements, can be found in the USDA’s Foreign Agricultural Service report, Angola: Food and Agricultural Import Regulations and Standards Country Report.

Conclusion

Since the end of the civil war in 2002, reliance on informal cantinas (open-air markets) in Angola has decreased, and formal retail is developing quickly as urbanization increases. According to the U.S. International Trade Administration, the changes in consumer demographics and improvements in infrastructure are steering more refined demands in the variety and quality of agricultural goods.

As the economic environment continues to improve and investment in infrastructure remains a priority, Angola’s growth in imports and production will continue to offer many opportunities for U.S. exports. While poultry is the focus of U.S. exports to Angola now, Angola is looking to expand options in many other categories of agriculture. With investment in dry and cold storage in port cities, Angola can become a large facilitator for trade with adjoining nations as well.

1 World Bank.

2 International Trade Administration.

3 Angola: Poultry and Products Annual Attaché Report; Report Number: AO2022-0002.

4 New Wheat Mills Expand Opportunities for US Wheat Exports to Angola: Report Number: AO2022-0001

5 U.S Department of State.