Spotlight: Morocco Fruit Exports

Contact:

Link to report:

Executive Summary

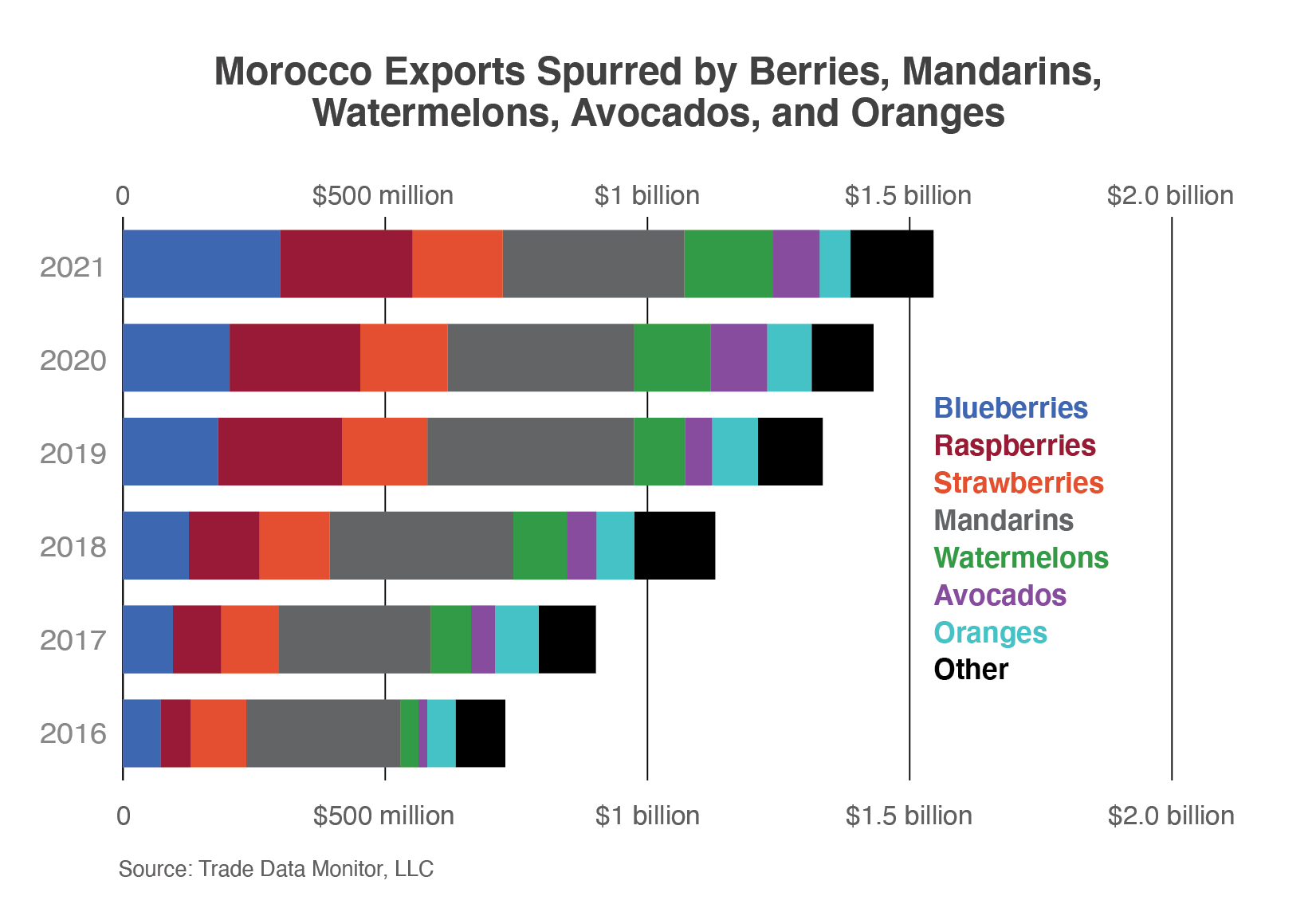

Morocco has become the 15th-largest fruit exporter in the world by value. According to the most recent estimates (2019) by the Food and Agriculture Organization of the United Nations (FAO), 66 percent of its land area is devoted to agriculture, with more than 7 percent devoted to fruit production. Morocco’s fruit exports account for less than 2 percent of world fruit exports, but considerable gains have been made in the last 6 years amidst an overall rise in global demand. Between 2016 and 2021, Morocco’s fruit exports more than doubled from $729 million to more than $1.5 billion, accounting for more than a third of their total agricultural exports in 2021. This was largely driven by substantial gains in berries (blueberries, raspberries, and strawberries), which now account for 60 percent of growth in fruit exports since 2016. A near constant but more modest rise in exports of avocados and watermelons has also contributed to expanding fruit exports, while exports of mandarins and oranges have contributed to overall growth, though they have slipped the past 2 years.

The increase in fruit exports has been facilitated by recent investments in transportation infrastructure, which now enables perishable items to transit from the southern Sahara region to Spain within 48 hours of packing. Morocco has the largest container port in the Mediterranean, and investments have also been made in the construction of a new deep-water port in Dakhla in the Sahara region, projected to be operational by 20271. The European Union (EU) remained the top market in 2021 for fruit exports, accounting for 70 percent of exports by value, with the nearby countries of Spain and France being the primary destinations. The United Kingdom (UK) replaced Russia as their second-largest market at 10 percent, while Canada and the United States each accounted for less than 5 percent. Morocco is the only country in Africa with which the United States has a free trade agreement.

Berries Lead Growth in Value of Fruit Exports

World production2 of blueberries, raspberries, and strawberries has experienced enormous growth in the past decade, driven by global consumer demand and enabled by quality-improving technology in genetics, harvesting, and packaging. With these berries accounting for 60 percent of fruit export growth since 2016, Morocco is riding the berries wave.

Blueberries

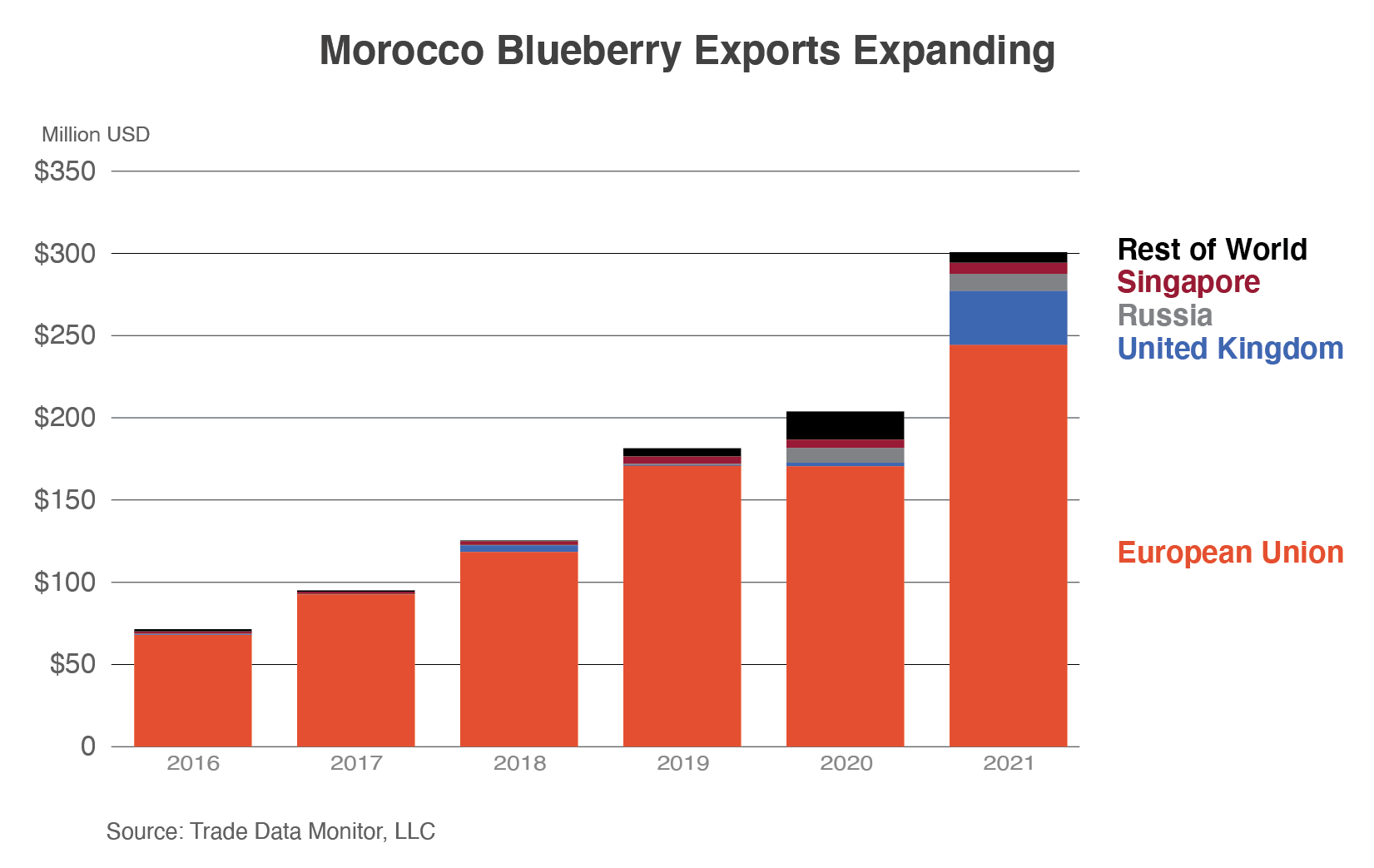

World trade in blueberries has surged in the past 10 years, propelled by the growing popularity of fresh blueberries and an expanding variety of blueberry products. Between 2011 and 2020, global production3 more than doubled to more than 1 million tons. Developments in genetics are enabling production in an array of climates, prompting the industry to expand to new regions, including Morocco. Production was initially in the northern part of the country but has spread to the southern desert region of Dakhla-Oued Ed-Dahab. Blueberries are currently harvested September through June; however, trials are being conducted in the Atlas Mountains for varieties that require cold temperatures which, if successful, would mean year-round production.4 Official production data is not available for Morocco, but export volumes have seen continuous growth between 2016-21, nearly quadrupling to more than 40,000 tons, and increasing in value from $71 million to $300 million. Rising volumes have also resulted in a larger piece of the world’s blueberry pie. Blueberries do not currently have their own 6-digit harmonized system code, so official global trade is uncertain, but it is estimated that Morocco’s share of world trade has similarly grown, rising from approximately 3 to 6.5 percent to become one of the top 10 exporters in the world.

Fresh blueberries accounted for 28 percent of Morocco’s growth in fresh fruit exports since 2016 and are now their second-most-valuable fruit export, with the bulk of shipments occurring January through May. The EU is the largest market by far, accounting for more than 80 percent by value and volume, and valued at $243 million in 2021. Morocco’s shipments to the EU overlap in the beginning of the season with supplies from Peru and Chile and at the end of the season with EU supplies, competing particularly with Spain. Morocco has risen to become a key EU supplier with 23-percent market share (27,000 tons), surpassing Chile in 2021 to become the EU’s second-largest supplier behind Peru. Though the majority of exports go to the EU, its markets are diverse. Combined shipments to all other countries make up only 15 percent of exports, but they extend to the UK, their second-largest market, and around the world to at least 30 other countries. Volume gains were made in all but one of their markets in 2021, while each of Morocco’s top seven markets have grown more than 100 percent by value since 2016.

Raspberries

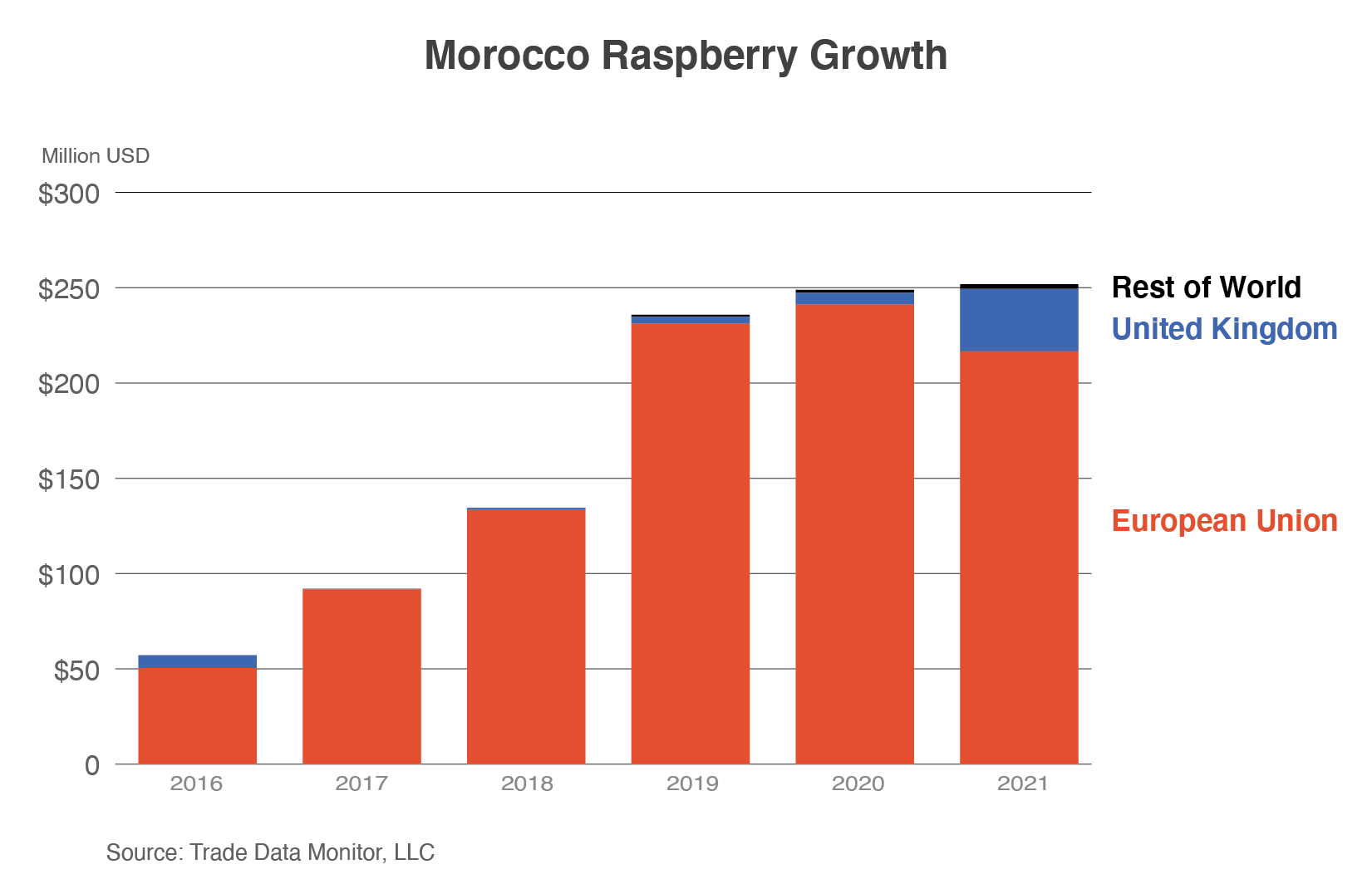

World production5 of fresh raspberries has also seen very dynamic growth, rising nearly 50 percent between 2011 and 2020 to nearly 900,000 tons as growers respond to rising consumer demand. Morocco’s raspberry production is concentrated in the northern part of the country but has spread further south to the semi-arid region of the Souss-Massa region6, with the growing season extending from October through May. Official production data is not available for Morocco, but exports have steadily risen between 2016 and 2021, rising more than 300 percent to more than $252 million, and quadrupling in volume to more than 40,000 tons.

Morocco’s third-most-valuable fruit export, raspberries, have accounted for 24 percent of growth in fruit exports since 2016. Though shipments occur year-round, the principal export season extends from September through June when they have a near-exclusive market presence in the EU. The EU is their top market by a significant margin, accounting for more than 80 percent of exports by volume and value in 2021 (34,000 tons valued at $217 million). Efforts by the raspberry industry to improve the quality, increase production, and expand trade have made Morocco the EU’s top foreign supplier. Near-constant growth in exports has boosted their EU market share from 38 percent in 2015 (6,000 tons) to more than 90 percent in 2021 (33,000 tons). The UK is the second-largest market, accounting for nearly 15 percent of total exports in 2021 (valued at $33 million). While exports are currently concentrated in these two countries, Morocco continued to diversify its markets in 2021, including to the United States. Shipments to markets other than the EU and UK have been minimal at 1 percent of total exports, but volumes to these markets are rising.

Strawberries

World production of strawberries7 grew nearly 40 percent from 2011 through 2020 to 8.9 million tons. Concentrated in the irrigated areas of Gharb and Loukkos, strawberry production8 in Morocco was more than 50 percent higher in 2020 than in 2011, growing from 111,000 tons to 167,000.

Strawberries accounted for 8 percent of Morocco’s growth in fruit exports since 2016. The strawberry industry has grown in direct response to overseas demand from the EU and UK, with exports to the world (fresh and frozen) jumping from $107 million (72,241 tons) in 2016 to $173 million (85,136 tons) in 2021, up 4 percent by value from the year before. Exports occur primarily between October and March. The EU is the top export market, accounting for 83 percent of exports, with the UK coming in at a distant second at 12 percent, and the United States third at 4 percent. Morocco averaged 39-percent market share in the EU during the past 5 years. Morocco’s geographical proximity gives it a logistical advantage in comparison to other exporters to the EU such as Chile and Mexico. Though exports are concentrated in the EU, Morocco is expanding its reach. As exports to the EU have eased the last 2 years, the decline was more than offset by higher shipments to other markets including Canada, Japan, and the United Arab Emirates.

Mandarins

Mandarin orange is a term that applies to a group of citrus fruits which includes varieties such as clementine, honey, satsuma, and tangerines. Most mandarins are sweeter than other citrus, but tart varieties also exist. Most mandarins have bright orange skin that is easy to peel and inner segments that are easily separated. There are seeded and seedless varieties. The terms mandarin and tangerine are often used interchangeably, which can be confusing because although a tangerine is a type of mandarin, not all mandarins are tangerines.

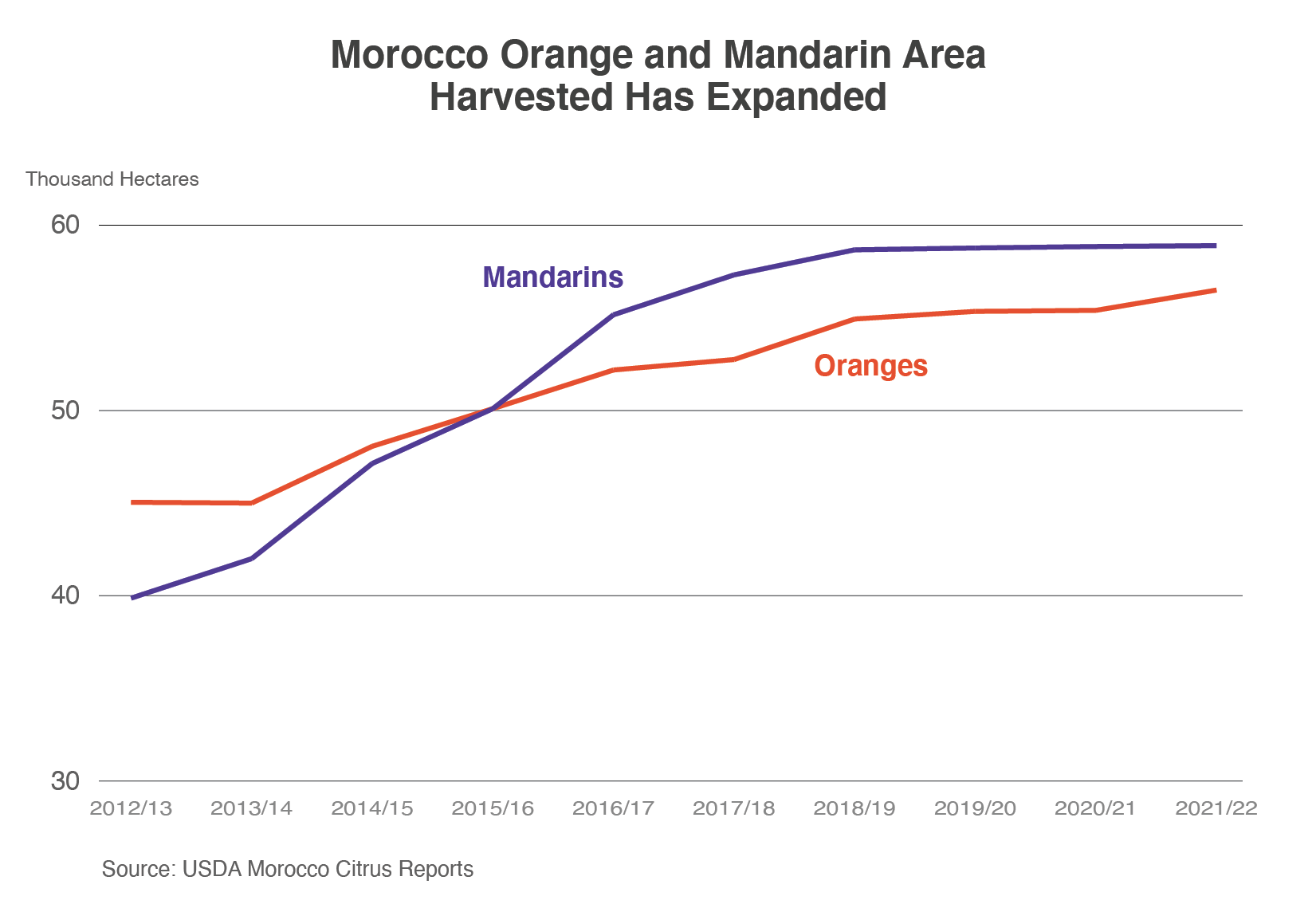

World production of mandarins has seen upward growth, rising more than 50 percent between 2012 and 2021 to 37.9 million tons due to producers responding to rising consumer demand. During the last 10 years, mandarin production in Morocco doubled to 1.4 million tons in 2021/22 with production concentrated in the Souss-Massa, the Gharb, and the Oriental regions. Area harvested expanded nearly 50 percent but has been relatively flat the past 5 years, with 2021 area harvested at 58,900 hectares (ha). Of the total tangerines/mandarins produced, more than 40 percent were exported.

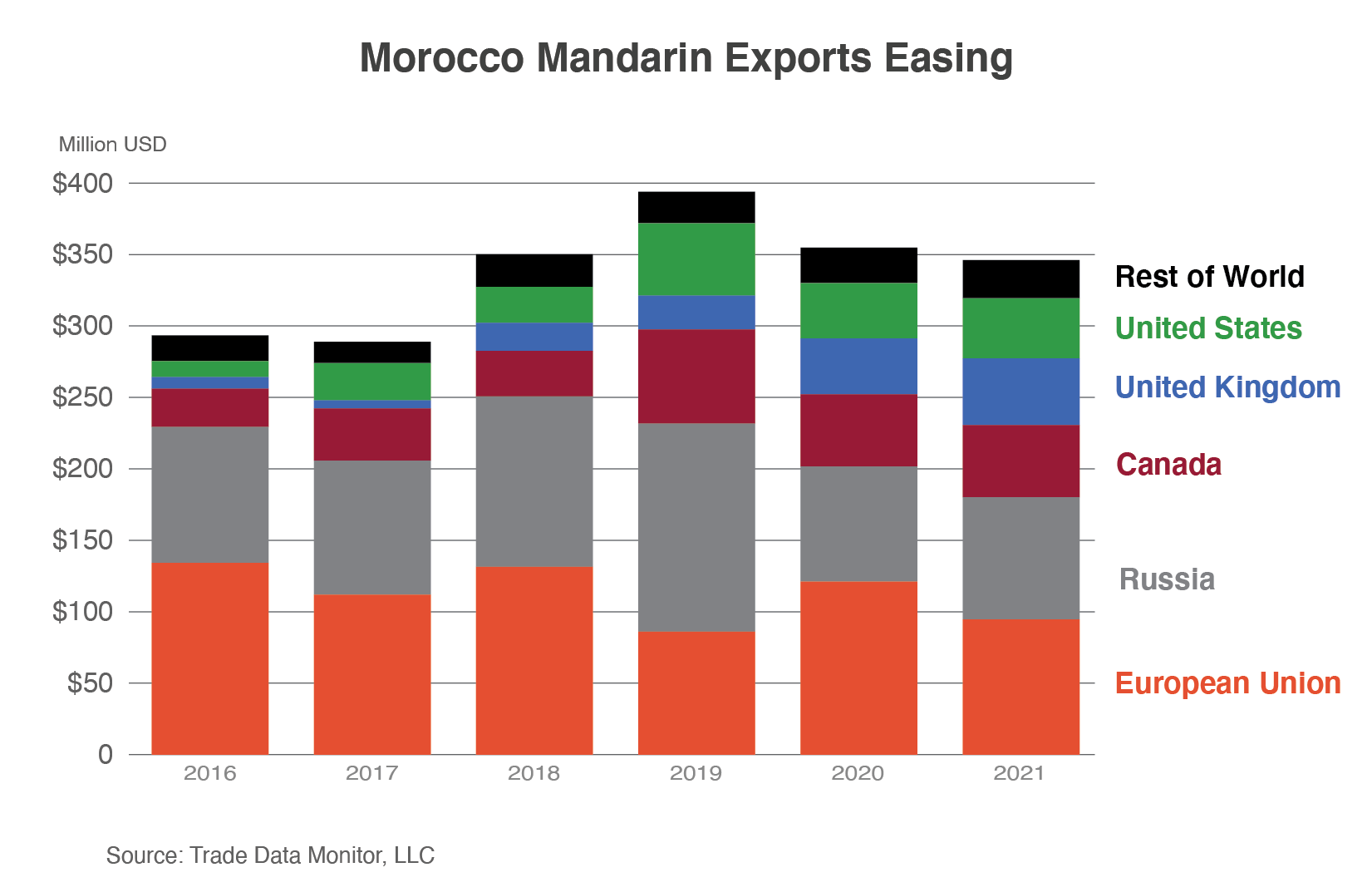

Mandarins accounted for 6 percent of Morocco’s growth in fruit exports since 2016. The mandarin industry has grown in direct response to domestic as well as overseas demand from the EU and Russia. Export values have eased from a peak of $394 million in 2019, but are hovering around $350 million, well above previous levels. Export quantities peaked in 2018 at 553,000 tons but have fallen to 465,000 tons in 2019 and 497,000 tons in 2021 due to lower production because of unfavorably high temperatures during the bloom and fruit set. Exports occur mostly between October and April. The top destination for mandarin exports during the last 6 years by value is the EU, accounting for 34 percent. Russia was the second-largest market at 31 percent, with Canada coming in a distant third at 13 percent, followed by the UK and the United States. With an average 27-percent market share by value during the last 6 years ($141 million in 2021), Morocco was the second-largest supplier to the EU between South Africa and Israel.

Watermelon

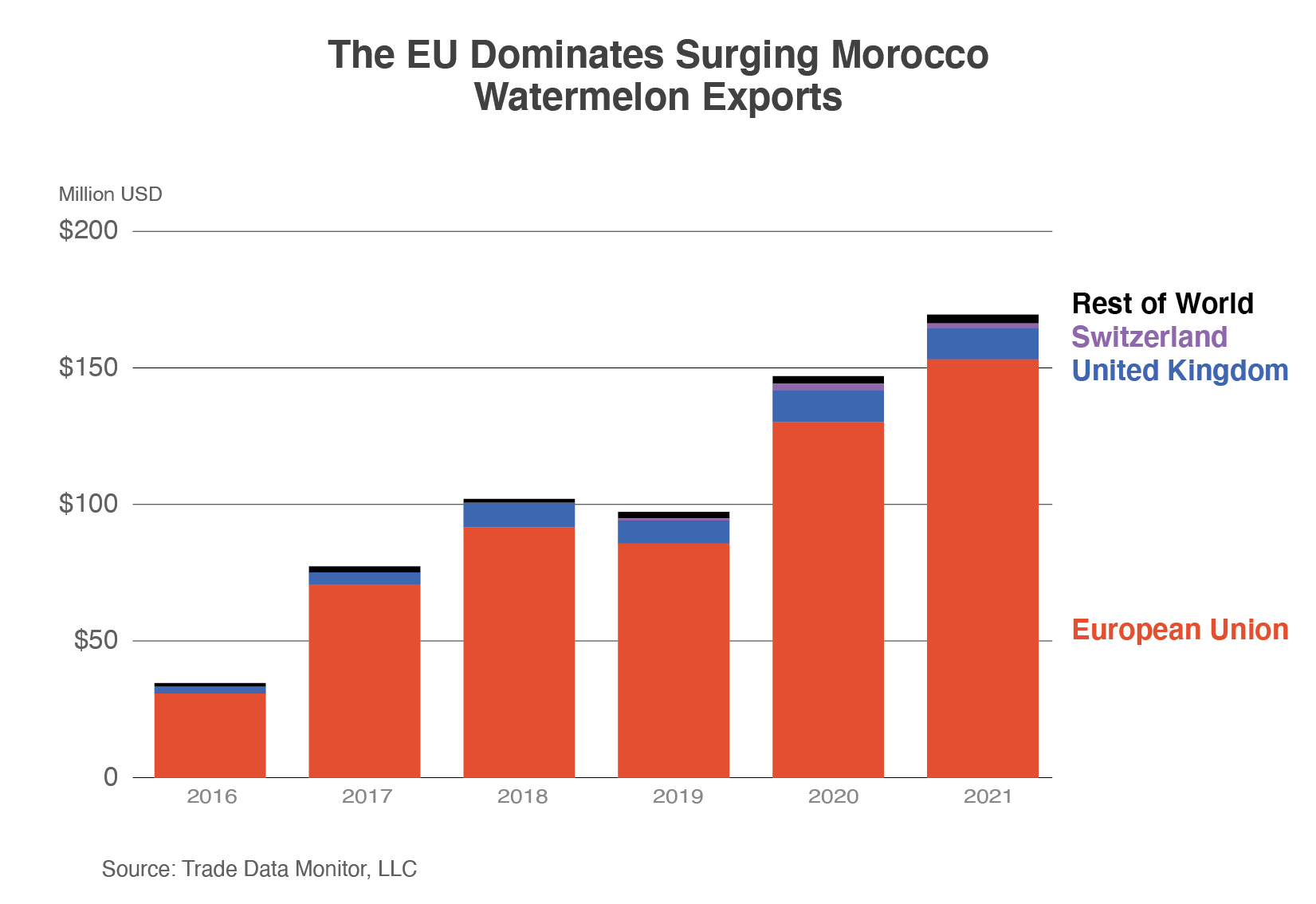

Global watermelon production9 has been on the rise, reaching 102 million tons in 2020, up from 95 million in 2011. Morocco watermelon production10 grew 17 percent from 2011, to 677,000 tons in 2020, and continued to grow in 2021. Production is concentrated in the South (Zagora, Ouarzazate and Errachidia), Gharb, Doukkala Abda, Souss-Massa, and the Oriental regions.

Watermelons accounted for 17 percent of Morocco’s growth in fruit exports since 2016. Morocco’s watermelon industry has grown in direct response to overseas demand from the EU and the UK with exports concentrated between March and October. The EU is the top market accounting for more than 95 percent of exports with the UK coming in at a distant second. Exports jumped from $35 million (79,610 tons) in 2016, to $170 million (257,737 tons) in 2021, up more than 15 percent from the year before. Morocco had a record 57-percent market share by value in the EU in 2021 compared to just 2 percent in 2012. Morocco’s geographical proximity to the EU gives it a competitive advantage in comparison to other exporters to the EU, such as Brazil and Costa Rica.

Avocados

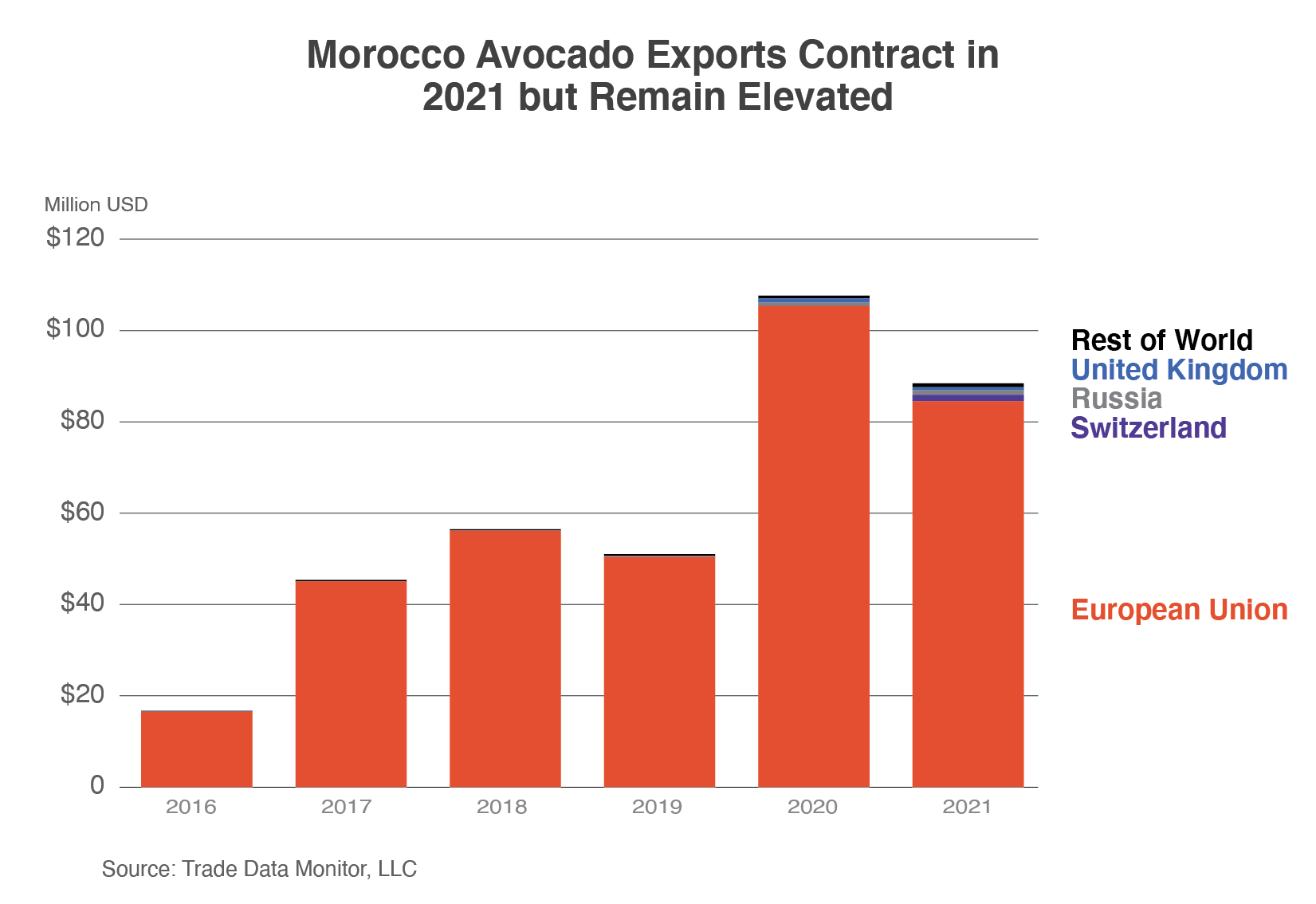

World production11 and trade of avocados has also seen vigorous growth, with production nearly doubling to 8.2 million tons between 2011 and 2020. Mexico and Colombia account for a significant portion of these gains, but Morocco has made significant strides. Despite accounting for less than 1 percent of global production in 2020, output more than doubled between 2011 and 2022 to 70,000 tons. Due to optimal temperatures, production is currently focused along the northern coast between Larache and Rabat.12

Avocados accounted for 9 percent of Morocco’s growth in fruit exports since 2016. Shipments increased nearly sixfold between 2016 and 2020 to 36,000 tons, valued at $108 million. Exports declined to 27,000 tons in 2021 but remained well above the 5-year average. Avocados are exported throughout the year, but more than 90 percent of shipments occur October through March, with top-market EU accounting for 94 percent of exports by volume. Morocco is the EU’s eighth-largest supplier, and though shipments to that market remain below 40,000 tons, exports nearly doubled in both value and volume between 2019 and 2020. Exports rose above $100 million and 35,000 tons for the first time in 2020 and improved market share to 5 percent. Beyond the EU, the number of Morocco’s export markets since 2016 has held steady and included more than 30 countries around the world in 2021, with all but 1 of the markets showing growth in volume since 2016.

Oranges

World production of oranges has been flat since 2012 at 50 million tons. Production in Morocco is estimated at a record 1.2 million tons in 2021/22, up 11 percent from the year before and up by one-third during the past 10 years. Production is concentrated in the Gharb and Souss-Massa regions. Unlike area harvested for mandarins, which has been flat in recent years, orange area harvested grew by a quarter during the past 10 years to 56,500 ha in 2021. Consumption has averaged around 80 percent of available supply. Of the total oranges produced, 10 percent are exported.

Oranges accounted for just 1 percent of Morocco’s growth in fruit exports since 2016 and occur between December and August. The orange industry has grown in direct response to domestic as well as overseas demand from Canada, the EU, and Russia. Exports to the world averaged $82 million (144,000 tons) from 2017 to 2020 but dropped to $59 million (95,000 tons) in 2021. However, exports are forecast to grow with rising production due to favorable weather and increased area as new orchards begin production. The top destination for orange exports is the EU, accounting for more than half of exports, with Canada second at 18-percent share, and Russia third with 13 percent. The UK, the United States, and Senegal are the next-largest markets, accounting for an additional 10 percent of the exports. With an average 9-percent market share during the last 6 years, Morocco is the third-largest orange supplier to the EU behind Egypt and South Africa.

Market share and global trade information is from Trade Data Monitor, LLC, unless otherwise indicated.

1 Foreign Agricultural Service (FAS), Office of Agricultural Affairs, Rabat

2 Food and Agriculture Organization of the United Nations; data is only available through 2020

3 Food and Agriculture Organization of the United Nations; USDA/NASS; FAS/Lima, FAS/Warsaw, FAS/Mexico City, FAS/Pretoria; International Blueberry Organization, 2020 “State of the Industry Report, Americas; International Blueberry Organization, 2021 “Global State of the Blueberry Industry Report”

4 Blueberries Consulting, “https://blueberriesconsulting.com/el-auge-de-marruecos-el-atractivo-polo-de-inversion-para-la-exportacion-de-arandanos/,” April 13, 2022.

5 Food and Agriculture Organization of the United Nations

6 Fruitrop, “Producer Country Profile – Berries in Morocco,” March/April 2018, No.255

7 Food and Agriculture Organization of the United Nations

8 Food and Agriculture Organization of the United Nations

9 Food and Agriculture Organization of the United Nations

10 Food and Agriculture Organization of the United Nations

11 Food and Agriculture Organization of the United Nations

12 Freshplaza.com, "Moroccan avocado cultivation is becoming increasingly professional and more compliant with European certifications," November 29, 2021