Browse Data and Analysis

Filter

Search Data and Analysis

- 441 results found

- (-) South Korea

- (-) Honduras

- Clear all

On November 4, 2022, the Korea Agro-Fisheries & Food Trade Corporation (aT) announced the results of the 2022 U.S. orange tariff rate quota (TRQ) allocations. Korea switched to a new license allocation system this year, replacing the import rights auction process used in prior years. A key piece of the new allocation system is that 80 percent of the total TRQ is reserved for importers with historical import volumes, while the remaining 20 percent is reserved for new importers.

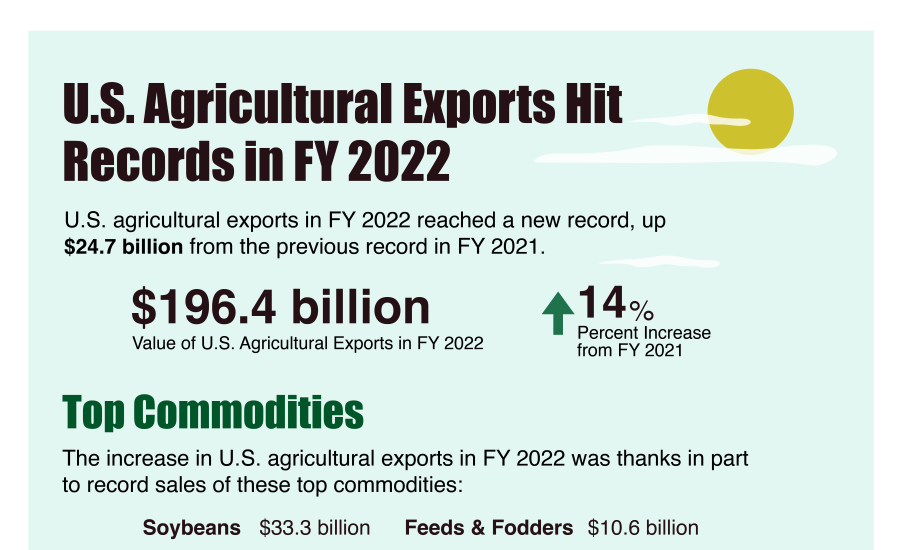

FY2022 agricultural exports reach record levels.

Korea’s 2022/23 pear production is projected to increase by 16 percent, driven mostly by increased yields due to favorable weather. Korean pear consumption is projected to rise by 14.3 percent following a 6 percent fall in market prices, with the balance of increased production going to exports. Fresh pear imports (including U.S. origin) are not allowed under Korea’s existing phytosanitary regulations.

SENASA and ARSA have made significant progress in expediting import procedures with the introduction of on-line options for requesting import permits, sanitary authorizations of imported raw materials, etc. that provides immediate electronic delivery to ports of entry. They also authorized in 2021 a private logistics hub that includes SENASA and Customs Clearance.

The National Plant, Animal Health and Food Safety Service (SENASA) is the regulatory agency in Honduras who is responsible for the inspection of all agricultural products that enter Honduras.

In 2020, sales of the HRI food service sector reached 140 trillion KRW (122.2 billion USD), a decrease of 3.1 percent from 2019. The pandemic affected the sector harshly and most of its sub-sectors experienced decreases in sales.

This report gives an overview of the food service – hotel, restaurant, and institutional sectors in Honduras and outlines current market trends, including best product prospects. In general, Hondurans like to dine out, both for convenience (mainly people working outside of the home) and on the weekends with family.

After two consecutive years of reduced chicken production in 2021 and 2022, Korea’s chicken production is projected to recover by 1.6 percent to 945,000 metric tons (MT) in 2023 due to increased chicken inventory and rising consumer demand.

Korean seafood imports totaled $5.74 billion in 2021, up 9 percent from 2020, with imports from the United States increasing slightly to $217 million. The United States remains the fifth largest seafood exporter to Korea with a 3.8 percent market share.

Sugar production and exports are projected slightly up in marketing year (MY) 2023 (October 2022 to September 2023) because of the increase in productivity yields, harvested area, additional investments in the sugar sector and increased exports as the Honduran Sugar Industry recovers from the impact of hurricanes ETA and IOTA in November 2020.

Interactive Tableau visualization showing what percentage of U.S. agricultural exports go to each of the top markets.

The United States is the leading supplier of imported consumer-oriented agricultural products to the Korean retail industry, shipping a record $6.2 billion in 2021. The outlook for U.S. products in the Korean retail industry is excellent for a wide range of products, including beef, pork, processed meat, vegetables, fruits, nuts, dairy products, juices and soft drinks, alcoholic beverages, condiments and sauces, processed organic foods, coffee, bakery products, snacks and confectioneries.