Browse Data and Analysis

Filter

Search Data and Analysis

- 297 results found

- (-) Indonesia

- Clear all

Following the approval of a GE potato variety in July 2021, the Government of Indonesia approved four GE corn events for domestic commercial cultivation in February 2022. The U.S. exported nearly $2.2 billion in GE-derived products to Indonesia in 2021.

The outbreak of Foot and Mouth Disease (FMD) has significantly disrupted Indonesia’s fresh milk production, which dropped 35 percent compared with the previous years’ production. The decline in domestic fresh milk production has been offset by a significant increase in imported whole milk powder. A rebound of the food service sector industry is expected to support a modest increase in the trade of dairy ingredients in 2022 and 2023.

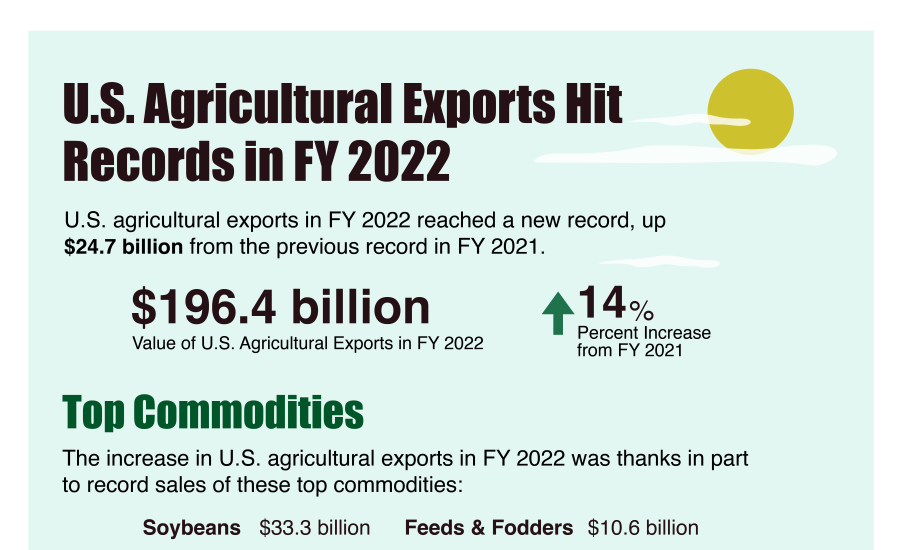

FY2022 agricultural exports reach record levels.

The Ministry of Agriculture (MOA) recently stepped up its enforcement of fresh animal product registrations. These new requirements are just two of the many provisions contained in MOA Regulation Number 15 Year 2021.

The Indonesian foodservice industry is valued at USD$22.8 billion, making it the largest market in Southeast Asia. Leading U.S. food prospects in this market include cheese, frozen potatoes, beef, fruits, pork, wine, and tree nut products that mostly used by international hotel chains, high-end restaurants, and international fast-food chains.

Palm oil exports for 2021/22 are revised down to 25.5 million metric tons (MMT) on restrictive export policies and weaker global demand. The soybean subsidy program launched in April 2022 unexpectedly caused several importers to slowdown purchases. Feed mill demand for soybean meal continues to drive imports from South American origins.

In 2022, Indonesia maintained its biodiesel blending mandate at 30 percent and raised its biodiesel allocation volume to a record 10.1 billion liters on expected increased economic activity and mobility following eased pandemic-related restrictions. The export levy that funds the subsidies underwriting the biodiesel mandate program was adjusted to also subsidize cooking oil prices which have surged since late 2021.

Wheat imports for 2021/22 are revised upward to 11.2 million metric tons (MMT) from the previous estimate of 11.0 MMT, reflecting recovering demand for flour-based foods. In line with increased imports, food, seed, and industry (FSI) wheat consumption is also revised up 2.2 percent to 9.1 MMT of wheat equivalent.

In 2021, the total value of all food and beverage retail sales in Indonesia totaled $72 billion, a 12 percent decrease from the previous year due to COVID-19 pandemic social distancing measures. Traditional markets still dominate the retail food and beverage sector, accounting for 76 percent of market share, although they continue to lose market share to modern retail stores and e-commerce.

Indonesia, the largest economy in Southeast Asia, was the 11th largest market for U.S. agricultural exports in 2021 valued at $24.5 billion. Indonesia is party to 14 Free Trade Agreements (FTA), creating tough competition for U.S. agricultural exports. Indonesia’s major FTA partners (i.e., Australia, New Zealand, China, etc.) also benefit from proximity.

Indonesia’s 2022/23 coffee production is forecast to increase by 7 percent from the previous year to 11.35 million (60 kilogram) bags on favorable weather in southern Sumatra. Improved demand following the easing of pandemic-related restrictions is expected to raise domestic coffee consumption to 4.8 million bags in 2022/23.

Private sugar mill expansion and higher rainfall as a result of La Nina weather patterns are expected to increase sugarcane yields, leading to increased sugar production in 2022/23. Despite the expected increase in production, imports of raw sugar are also forecast to increase, mainly due to higher sugar demand from the growing food and beverage industry.