Browse Data and Analysis

Filter

Search Data and Analysis

- 364 results found

- (-) South Korea

- (-) Georgia

- Clear all

As the 5th largest country export market for the United States, Korea provides a promising market for U.S. agricultural products. In 2021, Korea imported about $43 billion agricultural & food products from all over the world and the U.S. supplied a quarter of it, ranking number one. Other key suppliers were China, Australia, Brazil, and Vietnam.

U.S. beef exports to East Asia in 2022 are again on record pace after a record year in 2021. Despite economic uncertainties due to the COVID-19 pandemic, continued global supply chain challenges, and a competitive global beef market, U.S. beef exports to East Asia, both in value and volume, were outstanding in the first half of 2022.

Reduced open field "Unshu" mandarin harvest in the southern part of Jeju Island will drive Korea's total citrus production down slightly in 2022/23. Overall fruit quality is expected to be above average following reduced rainfall during the growing period, with higher Brix and lower sourness levels.

The ongoing revival of South Korea’s food service sector strengthened consumer demand for beef and pork in 2022. This positive trend is expected to continue in 2023 as Korea’s hotel, restaurant, and institutional sectors gain momentum in a post-covid market.

On November 4, 2022, the Korea Agro-Fisheries & Food Trade Corporation (aT) announced the results of the 2022 U.S. orange tariff rate quota (TRQ) allocations. Korea switched to a new license allocation system this year, replacing the import rights auction process used in prior years. A key piece of the new allocation system is that 80 percent of the total TRQ is reserved for importers with historical import volumes, while the remaining 20 percent is reserved for new importers.

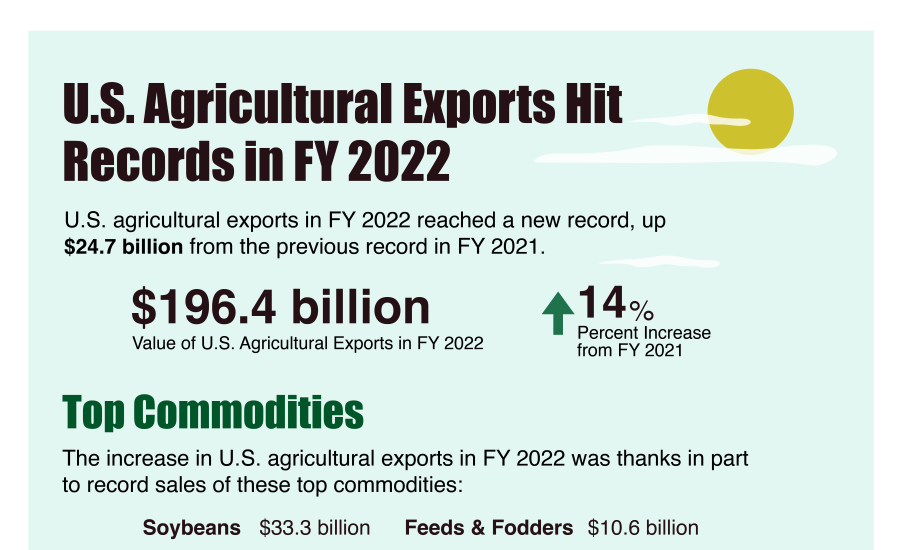

FY2022 agricultural exports reach record levels.

Korea’s 2022/23 pear production is projected to increase by 16 percent, driven mostly by increased yields due to favorable weather. Korean pear consumption is projected to rise by 14.3 percent following a 6 percent fall in market prices, with the balance of increased production going to exports. Fresh pear imports (including U.S. origin) are not allowed under Korea’s existing phytosanitary regulations.

In 2020, sales of the HRI food service sector reached 140 trillion KRW (122.2 billion USD), a decrease of 3.1 percent from 2019. The pandemic affected the sector harshly and most of its sub-sectors experienced decreases in sales.

After two consecutive years of reduced chicken production in 2021 and 2022, Korea’s chicken production is projected to recover by 1.6 percent to 945,000 metric tons (MT) in 2023 due to increased chicken inventory and rising consumer demand.

Korean seafood imports totaled $5.74 billion in 2021, up 9 percent from 2020, with imports from the United States increasing slightly to $217 million. The United States remains the fifth largest seafood exporter to Korea with a 3.8 percent market share.

Interactive Tableau visualization showing what percentage of U.S. agricultural exports go to each of the top markets.

The United States is the leading supplier of imported consumer-oriented agricultural products to the Korean retail industry, shipping a record $6.2 billion in 2021. The outlook for U.S. products in the Korean retail industry is excellent for a wide range of products, including beef, pork, processed meat, vegetables, fruits, nuts, dairy products, juices and soft drinks, alcoholic beverages, condiments and sauces, processed organic foods, coffee, bakery products, snacks and confectioneries.