The Growing Importance of U.S. Ethanol Exports for Industrial Uses

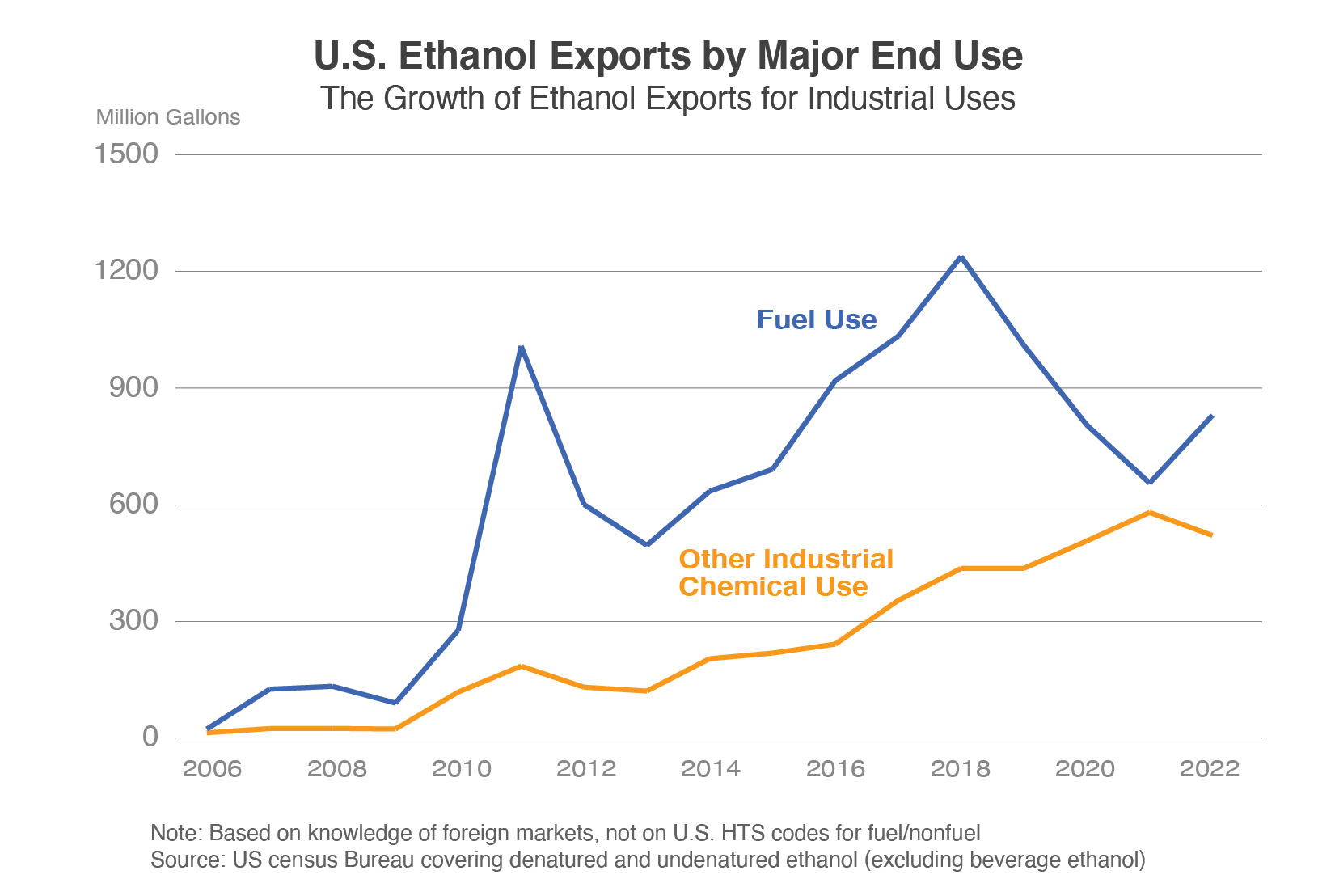

The United States transitioned from a net importer of ethanol in 2009 to the world’s largest supplier, exporting a record 1.7 billion gallons in 2018. While the use of ethanol as a fuel for blending with gasoline accounted for three-fourths of the export expansion, ethanol for other nonfuel industrial applications has seen slower but steady growth. With expanding uses for industrial ethanol, global demand will grow, including use as disinfectants, solvents, carriers in foods and cosmetics, commercial deicers, pharmaceuticals, and organic chemical manufacturing. The recent increased export demand for U.S. industrial ethanol is mainly tied to two factors: 1) demand for disinfectants and, more importantly, 2) growing industrial use from the manufacturing sectors of the Republic of Korea (South Korea), India, Mexico, Nigeria, and Europe.

Continued global demand for disinfectants, the emergence of biomanufacturing, and rising demand for “lower-carbon” consumer products are expected to expand opportunities for industrial ethanol. Ethanol’s continually improving carbon intensity (CI) score, consumer demand for environmentally responsible products, and countries’ interest in decreasing their greenhouse gas emissions will continue to create market opportunities for U.S. ethanol exports. Lower CI scoring now means that U.S. ethanol is eligible to compete for 100 percent of Japan’s ethyl tertiary-butyl ether demand. Additionally, new investments in U.S. plants manufacturing sustainable aviation fuel derived from ethanol are underway, creating another potential source of future demand. These developments will support fuel-ethanol exports, which have retreated since 2018 due to setbacks with Brazil, China, and the pandemic.